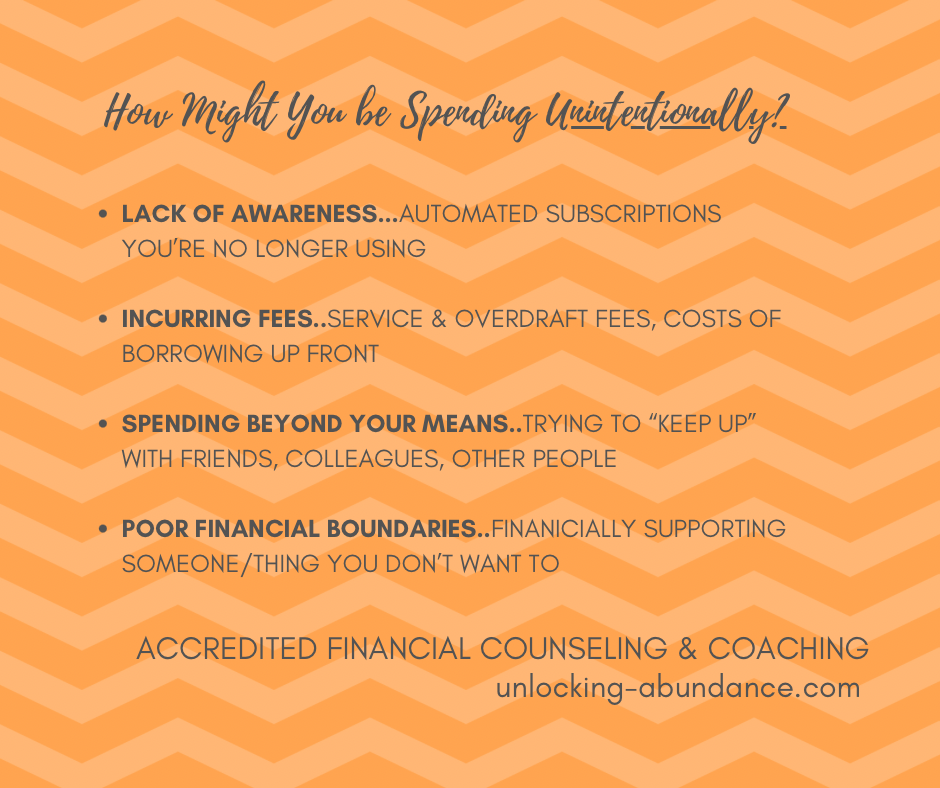

Have you ever felt like you should have more in your checking account? Where is your money actually going?! Intentionality is huge when gaining clarity around, and feeling good about, our spending. Read below for a few places to look…

Lack of Awareness: In personal finance, we’re all for automation. It really works to “set-it and forget it”, particularly around savings and contributions to things like retirement accounts. There is something to be said for the convenience! And, what if some convenience is causing you to spend more than you would prefer? When is the last time you actually looked at what is leaving your account on a regular basis? Could there be any subscriptions you no longer use or how about recurring charges that no longer align with your values?

Your Action: Check your auto-pays, see if they still line up with how you actually want to be spending. Add it up and take the win for the newfound savings!

Incurring Fees: Is it possible you’re taking on more fees and/or carrying higher balances due than is necessary? Are there any credit card balances getting low, that you can go ahead and pay-off, rather than make the minimum payments? Are there any auto-payments to credit card debt you can increase, even just a little? How much faster could you be closer to debt-free? Use this tool to find out!

Your Action: Check out your basic accounts and see if you are being charged any monthly fees and find out why. Even overdraft and bank fees can usually be avoided by a little tweaking. If you find you’re running low, and you have money in savings, consider padding your accounts a little. Look at your credit card balances. You may be surprised if one is getting low. Why not just pay it off? What could you be doing with that money instead?

Spending Beyond Your Means: If you feel like you have less money than you’d like, and not much tangible things or the memories that actually bring you joy, something is out of alignment. Where is your money going that doesn’t fit with how you actually want to spend it. Is there a lifestyle you’re trying to keep up with that you just can’t afford, or, even don’t want to?

Your Action: Look at what you spent your money on over the last month, flag any charges that bring a pang of regret and really feel into what it was your were trying to achieve. What was the feeling you were trying to buy? We all do it; give yourself grace. What matters is identifying what happened, and what you’re intending to do differently moving forward.

Poor Financial Boundaries: Is there any spending you can identify that might be out of guilt? Is there anyone unjustifiably counting on you for financial support, that you need to have a heartfelt conversation with? Is there an area where you can identify what you can actually give and feel good about? What does that look like and how might you express that?

Your Action: Your money is your resource to invest where you choose, at your own intention and direction. It might be worth getting curious if you’re doing just that. If there is a hard conversation that you’ve been putting off, you could reach out to a trusted friend and share how you’re feeling. Just sharing the emotion you’re carrying around can start to move the stuck feeling. Beyond support, you may even get some constructive feedback!

If any of these scenarios resonate with you, take your time and tackle even the easiest one first. How good would it feel to move closer to how you want to be spending your hard-earned money?