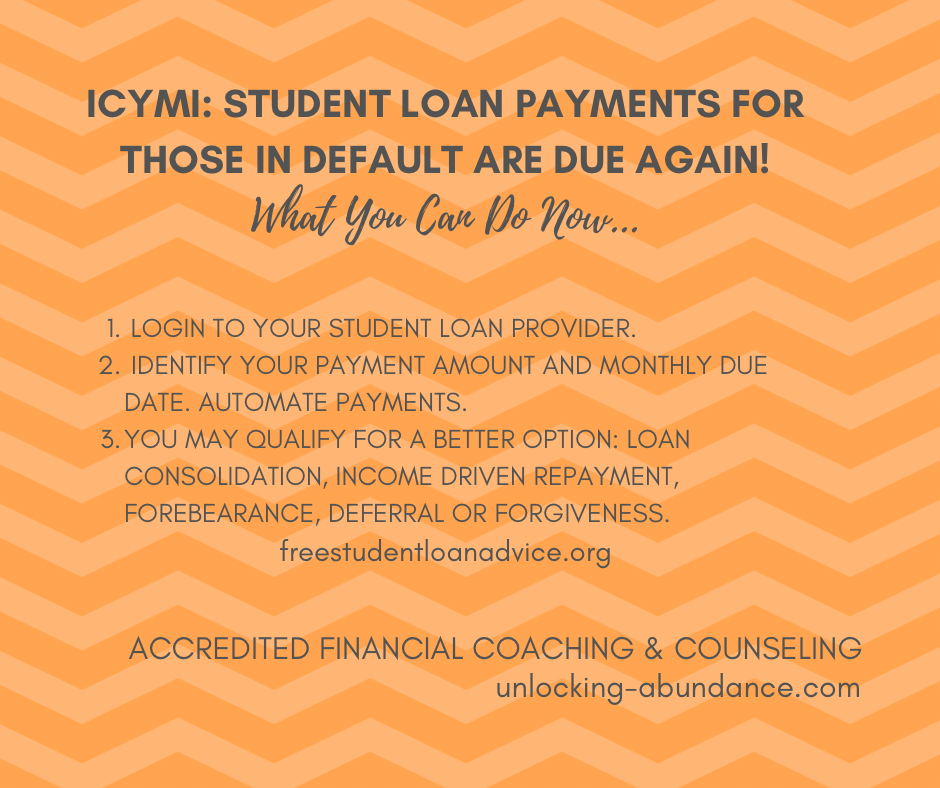

This week, the U.S. Department of Education required borrower’s with student loans in “default” (typically defined as federal student loans that haven’t been paid for 9 months or longer) to begin repayment. Many borrower’s have had their student loan payments in default since as far back as 2020, as result of pandemic relief. This new action is reported to affect as many as 5 million borrowers.

If Student Loan debt is stressing you out, you are not alone. There are literally millions of borrower’s trying to do their best within a complex, and slow-moving, system.

Student Loan debt is unlike many other kinds of debt. It does not just “go away after 7 years” and, if ignored, can have real financial consequences. “The federal government has extraordinary collection powers on its student loans and it can seize borrowers’ tax refunds, paychecks, and Social Security retirement and disability benefits.” –CNBC.com

The Biden Administration prioritized making student loan debt more manageable. Some of the latest creative legislation to come out in the last few years includes a Bankruptcy Update in 2022, which includes the option of wrapping in Student Loans. Also, as of 2024, The Secure Act 2.0 allows employers to match employee’s student loan payments, like they would a Retirement Match Contribution.

Other Student Loan Repayment Options You May Not Have Explored

Loan Consolidation: Eligibility to bundle multiple student loans into one debt payment. Many repayment plans require that student loans be consolidated.

Income-driven Repayment: Eligibility for student loan payment amounts that are based on income. The SAVE plan is one of the newer options.

Forbearance: Eligibility for temporary pause on payments due to a hardship.

Deferral: Eligibility that delays student loan payments while attending further education, military service or other criteria.

Forgiveness Options: Eligibility for student loans to be forgiven for employees in certain sectors, like teachers or public service workers.

Resources: studentaid.gov has so much useful information around student loan repayment, and freestudentloanadvice.org has the people on hand to help you navigate this system!

And finally, a Student Loan Debt pay-off hack that actually works!