Anyone else feeling anxious lately? A dose of uncertainty, perhaps? Coming off the heels of a pivotal election and having no idea what the future holds in some areas of life can be a lot!

These feelings can definitely impact our financial lives, whether leading us to self-sabotage through poor decision-making or perhaps impulse spending just to satisfy our own emotional discontent. Read below for a few ideas around how creating a SPENDING PLAN can not only allow us to feel better but also actually encourages our ability for to act with more spontaneity!

When you work with a Financial Coach to come up with a Spending Plan, one tailored specifically to you, you’re investing in your ability to move through life a little less bothered. A Spending Plan, which you may have heard called a “budget”, looks like an intentionally drafted document reflecting your projected income and specific directions of where you want your money to go, including routine expenses, fun money and your short and long-term goals, during a specified period of time.

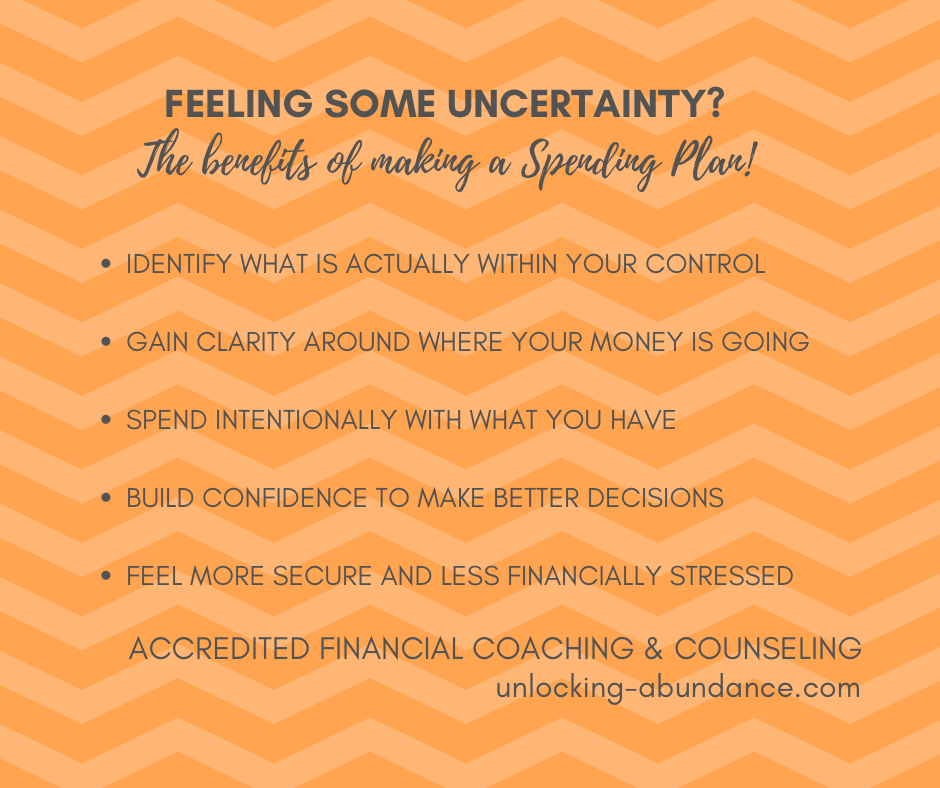

Recognizing that planning anything money-related (especially when it comes to saving and delaying gratification) can feel dull, and maybe even a bit painful–a Spending Plan ultimately unlocks your ability to achieve the following:

Identifying What’s Within Your Control

When you’re feeling stressed due to outside forces, identifying what you can control can be hugely impactful to your over-all well-being. Where do you have agency right now? What actions can you take that actually make a difference in your future?

When you DON’T feel in control of your finances, you might experience overwhelm, shame, and the inability to make smart decisions.

Spending Intentionally

Aligning your actions to what really matters to you, including where you spend your money, can help you live in integrity, which gives us purpose. What is important to you? What are you willing to part with, and if it’s painful to part with it, can you identify why and if you’re trying to please anyone else?

When you DON’T spend intentionally, you might experience frustration because you’re not making choices on your own terms.

Gaining Clarity

What does your financial picture actually look like? Can you answer these questions: how much money are you making, how much are you spending, and where is it going? Getting clarity boils down to “when you know better, you do better.” You can make informed and thoughtful decisions.

When you DON’T have clarity around your finances, you might experience having avoidance around your money in general; hoping for the best, and taking more risk than is necessary.

Feeling Secure

Our money is tied to our feelings of personal safety. We all want that feeling that everything is going to be ok and the belief that there will always be more money, rather than living in an environment of lack.

When you DON’T feel secure, your base-level emotional needs are not being met, and you might feel additional stress and anxiety.

Make a Spending Plan! Live with the results, tweak the plan, keep moving forward with financial cushions in place that give you the ability to pivot, and everything gets less stressful. How good would it feel to have a little more control in life right now?