As we’re nearing the end of the year, let’s take a look at how you can strategize your Savings this final quarter in order to to make life easier in 2025! Read below for some advice developing your new Savings Plan, and by putting in the work little by little, until year end, optimize for a big payoff in the new year!

A client came to me recently, ready to look at their own spending up close and personal, in order to identify exactly just where their money had been going all year long. This is the first step to gaining clarity around your money, and right now is a great time of year to do it!

Having some time between now and the rest of the year to get a handle on just a few things may be impactful for the system we can implement for next year. For example, those little irregular expenses that might have been a challenge this year can be identified and remedied.

We can set a plan in place by using Sinking Funds (or a Savings Account for very specific purpose) in order to cover those expenses we know we will need to pay for next year–but not necessarily every month.

Think of any irregular expenses such as:

–Paying taxes through out the year (especially important for entrepreneurs and contract workers)

–Car insurance

–Routine vet bills

–Medical bills out of pocket

If you like the idea of the peace of mind you may experience by having some specific funds set aside for instances like those, you can spend a little time on this now. Pace yourself–you don’t need to do everything all at once!

What was that specific nagging expense that hit you this year, that very well could show up again next year? Identify an expense category (or two) where you would like to gain a little more control. Then, take a look at the statements for how you paid that vendor specifically. Perhaps it was with a certain credit card, bank account with debit card, or online app. Go there and review how much you spent on that category this year, and also anticipate how much you might spend by year end. Take that total, add a little extra (because costs typically increase year-over-year) and divide it by 12.

This is the monthly amount you can start saving away in that Sinking Fund. When you fund this account, regularly, automatically, and in an accessible place with higher interest all year long, like a High Yield Savings Account, the system functions behind the scenes so you don’t have to do anything other than the initial set-up and you have a place to turn when those specific bills come up.

Tip: set up the online transfer to be recurring and inline with the day (or a couple days after) you typically get paid, and don’t use the same paycheck that covers major expenses like rent.

You can pull from that account with no worry or guilt that you’re spending money designated for something else. You saved the money for that purpose–intentionally.

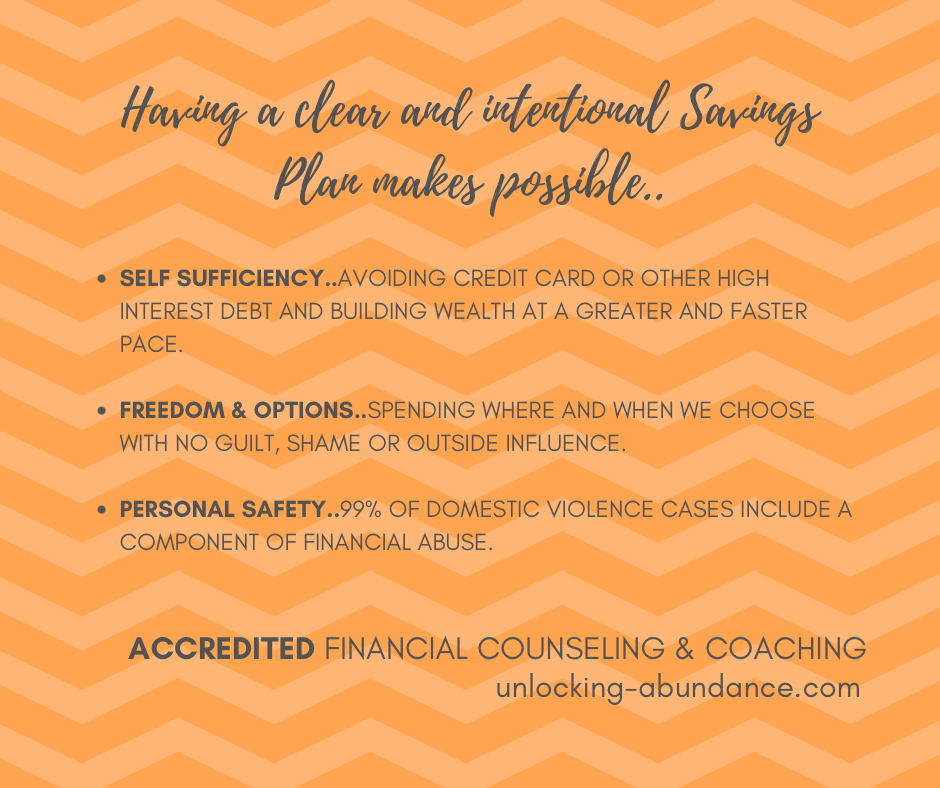

This action of being intentional, by planning for and saving ahead, allows for financial independence and freedom from debt. You can turn to your own money rather than another source charging high interest and designed to keep you cycling through often never-ending monthly payments. You also have a greater amount of options which creates a greater sense of autonomy–providing for your own needs, including personal safety.

How good would it feel to know you have a system in place to keep you a little more secure?