Let’s talk Property Taxes!

If you are a homeowner, you are no doubt familiar with that line-item on your mortgage statement, sometimes designated “Tax-County”, which always seems to fluctuate each year. It can fluctuate by a lot, actually, if you live in a county experiencing tremendous growth, like us here in King County, Washington State, home of the Seattle tech-bubble. The Seattle Times even reported earlier this year that Seattle has the 5th highest median property taxes in the nation, with an increase of 89% since 2010. If you’re feeling your property taxes have been rapidly increasing, with no end in sight, you’re not alone.

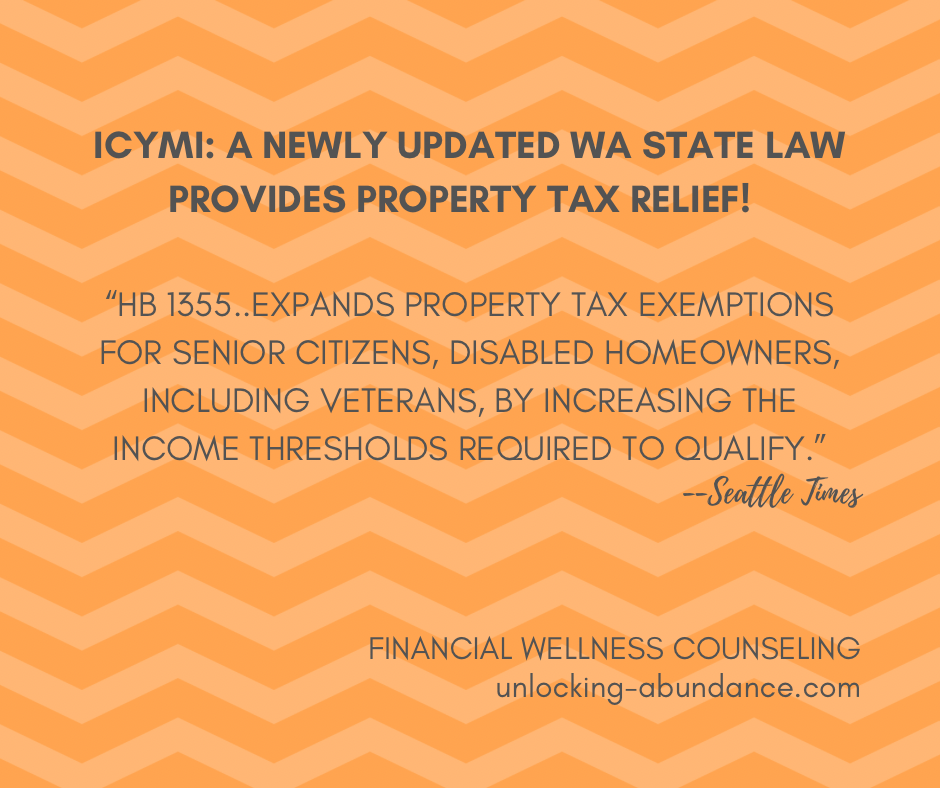

Read below for a refresher on what exactly property taxes are used for, and some newly updated legislation that might make them a little more affordable for seniors, disabled folks (including Veterans), and a quick-tip on how you might lower your property taxes even if you don’t qualify for the new update!

Property Taxes are collected from homeowners by our County Officials, in order to fund community-used resources such as public schools, fire departments, the police and EMT’s, libraries, and parks, just to name a few. The Washington State Department of Revenue reports that Property Taxes make up about 30% of our state and local taxes! Admittedly not an expert on state-level tax collection, levies and calculations, roughly, these types of taxes are calculated by the local tax rates against the value of your property. They differ across the nation.

Here, in Washington State, the incredible increase in property taxes has left some specific groups in a real pinch. Particularly, low-income seniors, disabled folks, including veterans, who are often left to live on a fixed income. It’s been evident that for many of those in older years, who have paid off their mortgages, property taxes continue to climb and can be a real burden trying to make ends meet.

This is where a new update to law HB 1355 is stepping in to add a little relief. The update increases the opportunity for property tax exemptions, specifically for senior citizens (aged 61+) and disabled homeowners and veterans. The update to the bill, which was signed into law in 2023, is just showing it’s benefits now since it uses last year’s tax year as qualifying data. The bill increased the income limits to qualify for a property tax exemption. In King County, for example, the income threshold increased from $58,400 to $72,000. That means that in real dollars, it has been estimated that a qualified homeowner with a $690k valued home could save over $5k a year in property taxes.

If you live in Washington State, and think you might qualify, you can find the specific participant limitations here and then you can enroll for exemption.

What if I Don’t Qualify for the Exemption?

Even if you don’t qualify for this updated bill, you might be able to lower your property taxes but it will take a little time, effort and a cut of your eventual savings. You can google “Grieve my property taxes” and you should find companies offering to fight to lower your taxes for you. They often operate by taking a cut of your savings for the first few years, but as with any service you pay for, you will need to read the fine print of your agreement. Make a point to fully understand what you are signing up for, what the costs will be, and what the odds are you will prevail.

Another available route, if you believe your property is inaccurately assessed and your taxes are too high, is to appeal the current valued assessment with your local county. You can find more information on appealing in Washington State here.

The more you know!