Hoping everyone had a fun, safe and healthy 4th of July!

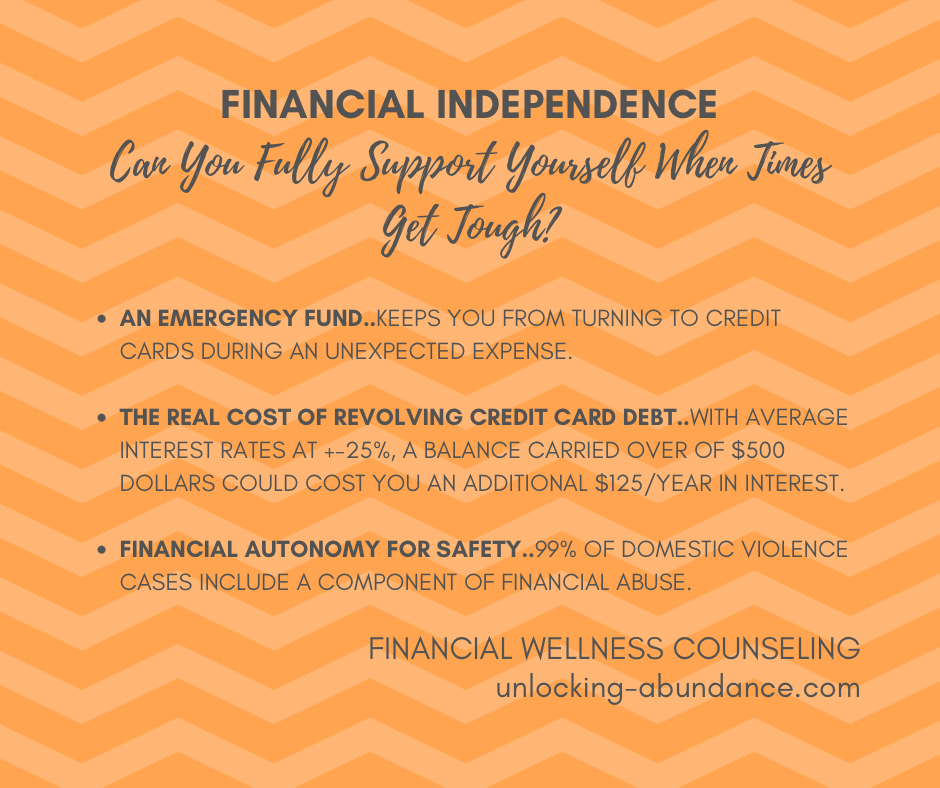

Along with celebrating our National Independence, how about touching on the importance of becoming financially independent?! There are many reasons that financial independence is crucial to living a balanced, autonomous and functional life. Below, we will explore a couple of those relating to living debt-free and our own personal safety.

Financial independence, or not having to rely on outside sources to meet our basic needs and more, directly correlates to our ability to build wealth. It’s the degree of success within our personal money-management that provides the real freedom to make our own choices. Essentially, when you can pay for things yourself, you can typically do more of what you want—and usually spend a lot less money doing it!

Ask yourself, ‘how financially dependent am I?’ Who do you rely on, and what is the real cost? How might you start leaning towards financial independence?

One foundational tool in building your own financial independence is to have a fully-funded Emergency Fund.

How Can I Get Started Saving for an Emergency Fund Right Now?

First, you can determine how much of an Emergency Fund is right for you. What are your fixed monthly costs? This is where have a Spending Plan (aka “budget”) really helps. You can also just take a moment and pull a recent bank statement. What are the fixed costs that you can identify that will likely come up month-to-month? Take that number and multiple it by it by 3 or 6, or however many months would be ideal for you to feel covered. The total you come up with is the goal amount for your Emergency Fund. Consider adding a little extra to the total in order to account for unexpected medical bills, a car repair, or anything that may not be reflected in your month-to-month analysis.

Tip: divide your new goal number by 6, and as long as you start putting money away now in the month of July, that is the monthly amount required to fund your Emergency Fund by year end! How good would that feel?!

If the number you came up with makes you feel overwhelmed, don’t fret. Emergency Funds are built over time. The only thing you need to do is get started, even if by the tiniest amount regularly! You can start by putting a little amount into a special savings account, where you know that money in there is only for one purpose: an unexpected life event.

You can open a High Yield Savings Account and set up an automatic transfer that coincides with the day you get paid. Using this type of account might allow you to hit your goal faster than using a traditional savings account (although, that’s fine too—if that works better for you!) because the interest rate is so much higher. Use this online savings calculator to see how long it will take to hit your goal, at different interest rates!

Tip: if you work for an employer, many allow you to set up an automatic transfer directly to the account on the day they cut your paycheck, that way it’s taken care of and you don’t even have to think about it.

What if I Don’t Start an Emergency Fund, and Choose to Rely on Credit Cards?

If you have no Emergency Fund, the typical next stop in paying for an unexpected expense is to put it on a credit card. We’ve all been there..

It’s true that credit cards are great tools when you are able to fully pay them off without accruing interest! When paid off in full and on time, they actively help you to build credit and increase your credit score, which allows you to save money by receiving better rates when it comes to borrowing money.

When you perpetually carry a balance, however, not only might your credit score decrease, you’ll likely end up spending a lot more money than the original purchase price, simply due to accumulating interest charges. Have you checked each and every credit card you have to identify the interest rate in order to get an idea of how much extra you are being charged? Calculate how much your credit cards are costing you here.

Tip: If you’ve been in good standing and paid your credit card bills on time, contact each credit card company and ask for a reduction in the interest rate, or “Annual Percentage Rate (APR)”. Lower interest rates equal less money out of your pocket–a lot less money if it’s over a long period of time!

Beyond Building Wealth, How Does Being Financial Independent Keep Me Safe?

Finally, we can’t talk about the importance of financial independence without highlighting the importance of safety. Money is directly tied to our security, after all, and to our ability to act on our own accord, which includes the ability to leave a dangerous situation. It’s been reported that financial dependence is one of the top causes that victims stay with their abusers.

It’s hard to leave a bad situation when you have little money. Having access to our own money allows us to make important decisions and have the resources to back them up. Keep some of your own money accessible to you and you only. It could be the difference between being able to leave an unhealthy situation, or not. Recognize the signs and symptoms of financial abuse. If you, or someone you know, might be a victim of domestic/financial abuse you can find valuable resources at joinonelove.org/get-help/.

What action can you take now that will move you one step closer to being financially independent? And what would be made possible for you by doing that?