Following up on end-of-life planning documents, let’s dig into the Financial Power of Attorney! If you’re reading this, there is a good chance that at some time in the future, you will either need to create one, or become one for someone else. This post is dedicated to the gathering-information phase in order to do so!

Read below for more on the Financial Power of Attorney: what it is, what you may be responsible for if called upon to be one, and what kind of information may be helpful for you to gather in advance! As always, not legal advice!

What is a Power of Attorney (POA)?

Power of Attorney is a general legal document that designates someone to do something specific for someone else, for a stated period of time. Examples of common Estate Planning POA’s are the Advance Healthcare Directive, or the Financial type.

The Financial Power of Attorney is a legal document that specifies an “Agent”, or person who will manage the financial affairs of the person who creates it, sometimes called the “Principal”. These duties can include but are not limited to: banking transactions, lending and paying bills, selling assets or property, etc. Whatever the Principal wants handled financially when they can no longer do it themselves due to incapacitation.

Who Needs a Financial POA?

Anyone who wants to appoint someone in advance to be responsible for their finances once they cannot do it themselves. This saves possibly money, and others’ time and resources trying to get their own access through the courts, depending on state laws where they live.

What Do I Need to Know if I’m Appointed as Someone’s Financial POA?

You should receive a copy of the signed legal document, and understand what you are responsible for and for what duration of time. You may want to make a checklist and gather information.

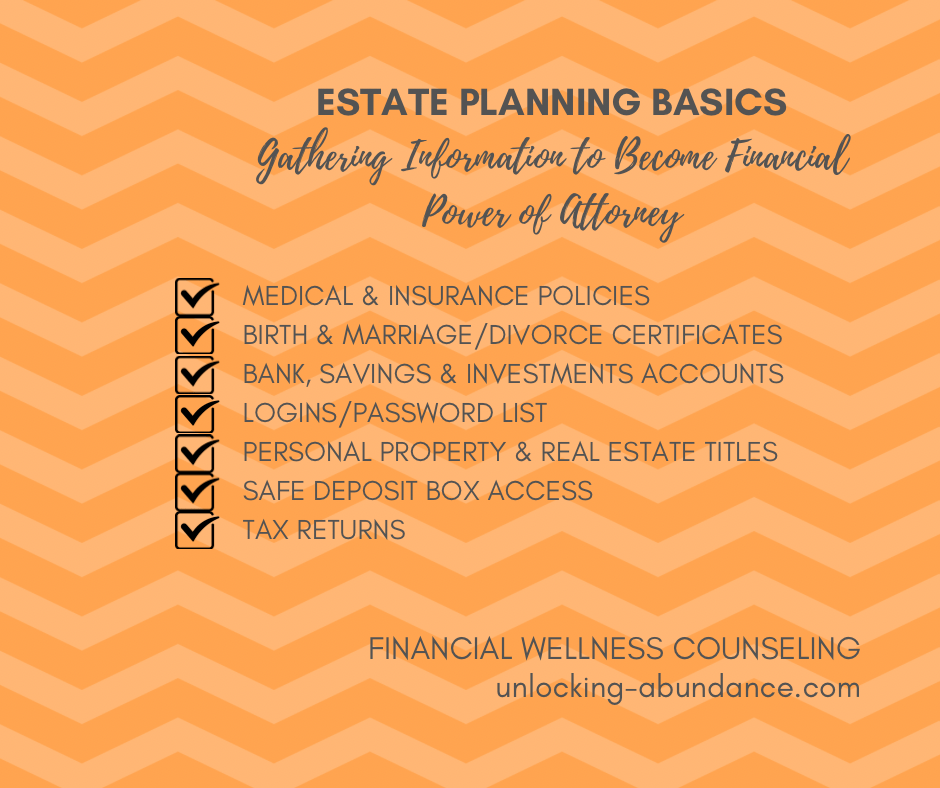

This list may include, but is not limited to:

–Medical & Insurance Policies such as home, auto, life, etc.

–Birth & Marriage/Divorce Certificates in case you need further personal information.

–Bank, Savings & Investments Accounts with their logins/passwords to do online banking.

–Additional Logins & Password List for all online accounts.

–Personal Property & Real Estate Deeds in case you need to sell assets.

–Safe Deposit Box Access if necessary.

–Tax Returns for any further taxes due.

What is a Durable POA vs Non-Durable?

Durable means that the document continues to be legally enforceable beyond the point the Principal becomes incapacitated. Most Financial POA’s are designated “durable” because they are intended to become active at the time the person can no longer take care of their own finances. Non-durable POA’s are only legally enforceable during the time specified that the document remains active.

I Think I Might Need My Own, or Become Someone Else’s Financial POA..What Should I Be Doing Now?

If you think you might have a need for a Financial POA, do some DIY research, use a legal online template, or speak with an Estate Attorney in order to identify your specific needs. Once the document is drafted, let anyone on the document who is listed have a copy and let them know where the original is kept. (Some people list a back-up Agent in case the main person isn’t available to do it.)

If you can think of someone in your life who may need you when they can no longer manage their own finances, have that conversation now and gather any details that you can in advance, so that when the time comes you can not only be prepared but can minimize stress during what might be a very chaotic time. With these end-of-life documents, being proactive rather than reactive is the pathway towards finding peace-of-mind.

Helpful Resources:

Free Downloadable Digital Assets/Password Worksheet.

Book/Organizer/Planner: “I’m Dead, Now What?” keeps all pertinent information in one handy binder.

Instagram Influencer/Author Chanel Reynolds “Get Your Shit Together” for all things end-of-life readiness, including free checklists.