The average tax refund this year was over $3k, and that has increased from last year! That is some impactful money!

What did you, or will you do, with yours? If you are interested in making the greatest impact, read below for a few guidelines around whether to pay off debt, invest, or put your refund into savings!

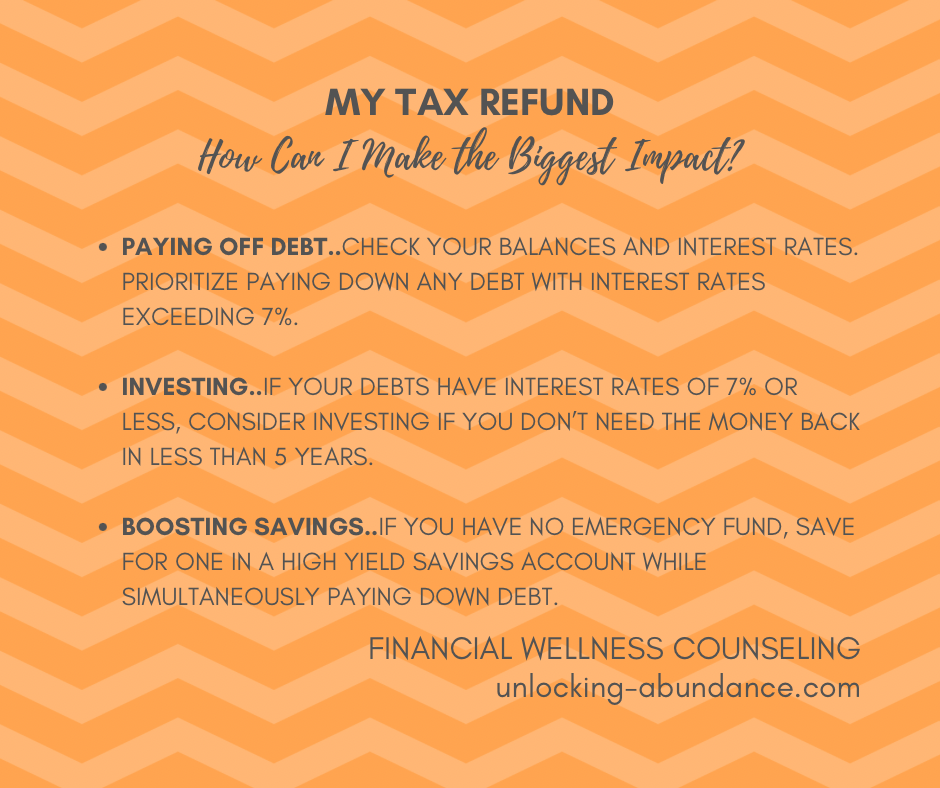

Reducing Debt:

The rule of thumb has typically been that for any debt you carry that has an interest rate of less than 7%, you’d be better off investing your money rather than paying off that debt. This is because, invested, you could possibly make more than a 7% return on your money.

That said, the average credit card APR (Annual Percentage Rate—the money you pay the credit card company in interest in order to use their money) these days is at least 25%. Therefore, it might be a good idea to prioritize paying off credit card debt before investing. Making only those minimum credit card payments is a vicious cycle that will not only keep you from your money goals, but from living your best financially-savvy life. You can tackle getting rid of this debt a few different ways; the best way is the one you find most motivated to get started.

If you’re struggling with debt, you’re absolutely not alone. Take a moment to consider two things: what your debt is costing you, and how does carrying the debt make you feel? What is it costing you, both financially and emotionally, and what would you prefer to be doing with the money you’re using for revolving credit card payments? What could be made possible once those monthly payments are gone? With some commitment and patience, you can for sure get there!

Investing:

Again, if the interest rates on your debts are less than 7%, consider using your tax refund towards investing. The general guidance here is to understand both your risk tolerance and your time horizon. Meaning, how soon do you need this money and what is it for? If you need the money back in less than 5-7 years, it might take that long to break-even if the market was to experience a downturn. How comfortable are you with riding out those downturns? You come up with the solution of how much you’re willing to put away, and for how long.

Think about this: what might you be missing out on by NOT investing? Time is absolutely your greatest asset, and it’s consistency overtime that brings the greatest results in finance. That time is going to pass by regardless, how are you making use of your time, and your money, right now?

Boosting Savings:

If you don’t have a savings account that is specifically for your “Emergency Fund”, think about how you would pay for the next unplanned expense (medical bill, car or home repair, job-loss, etc.) and determine how that would affect where you want to be, debt-wise. This fund is exactly what saves us from getting into a spiral of credit card debt. Building savings, and then using our own money, is often a better deal than borrowing and paying back.

In order to get started, take your monthly “Needs” (fixed costs like rent, utilities, groceries, etc.) and multiply that number by 3 or 6, or however many months you’re comfortable with if your income stopped or you incurred a large unexpected bill. That number is your Emergency Fund savings goal. Next, you can divide your savings goal by the number of months you would like to get there, and automate that amount by recurring transfer to your Emergency Fund. You can do this once a month, in-line with the day you get paid. Using a High Yield Savings Account will get you there quicker!

Note: You can save up for an Emergency Fund and pay down debt simultaneously. In that case, shoot for a smaller cushion for your Emergency Fund, just to get started, while prioritizing paying more than the minimum on your credit card(s). Balance is possible! Do your own calculations with this Savings Calculator and you can see how quickly your money will grow! Pay attention to the interest you’re accruing simply by using a High Yield account.

You have your refund; your next action step is determining what you want to do with your money that would be most impactful to your circumstance. After that, automate and check progress regularly! How good would it feel to fund the future you want to live, by taking action right now?