Tax day is right around the corner!

Read below for some important reminders on due dates and avoiding penalties, as well as an introduction to a new FREE filing option this year—Direct File! We’ll also touch on the Working Families Tax Credit, another option for families in Washingtonian State to get more money at tax time! As per usual, not tax advice!

Tax Day Filing Deadline: Monday, April 15

Refresher on Penalties:

Failure to File: Up to 5% of the tax amount due, per month, since it was due. Interest may be added on.

Failure to Pay: Up to 0.5% of the unpaid tax due, per month, since the return was due.

Failure of Accuracy: Up to 20% of the under-reported amounts.

Need more time to file? File an extension, Form 4868, before the April deadline and you may increase your filing deadline by a few months. Be aware, taxes owed are still due now. This action allows you to avoid the additional penalties had you not filed on time.

Need to get on a payment plan? You may qualify for an Installment Plan, or a “Compromise”, for those who prove they do not have the means to pay.

Bottom line, even if you can’t pay, work something out with the IRS. A little good faith goes a long way towards avoiding cumulative penalties.

Two New Important Tax Options for Washingtonians:

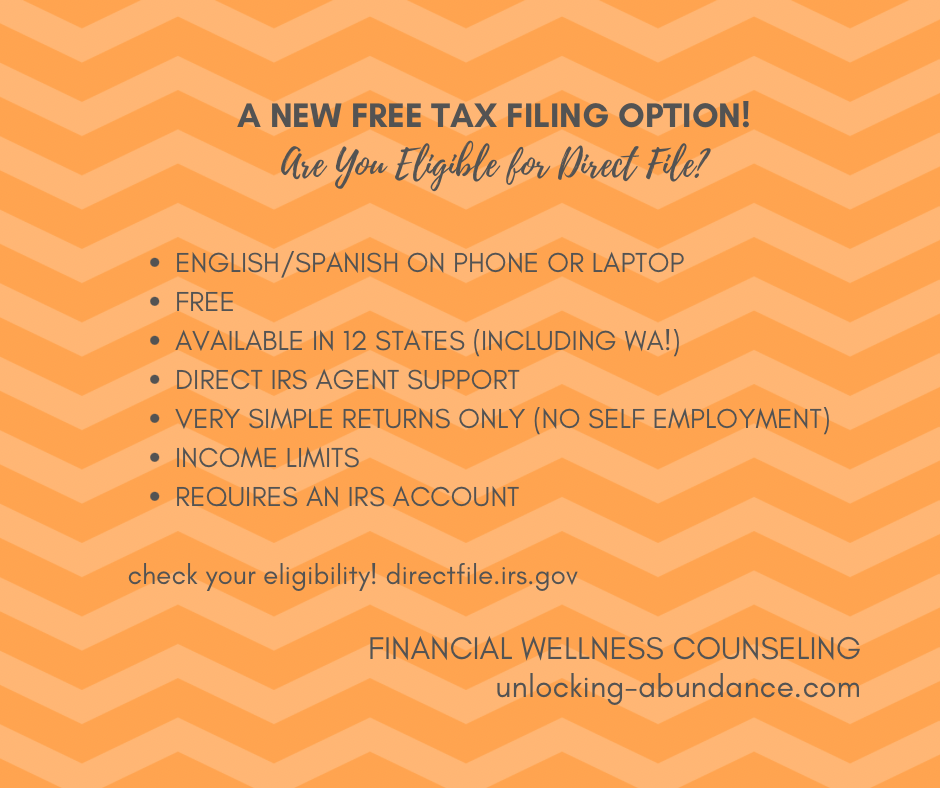

Direct File

Direct File is a new pilot program for filing your taxes, directly with the IRS, available now in just 12 states (including Washington!). It was created as part of the Inflation Reduction Act. It is a FREE program and has been getting rave reviews because of it’s simplistic interface, as well as quickly-timed customer service (direct IRS agents) on hand to answer filing questions.

You can use the program online through your computer, or phone, in Spanish or English. Those who do qualify will have the simplest tax returns; no self-employment income or anything beyond your standard W-2, Unemployment Income or Social Security Benefits. No Gig or Independent Contract work is eligible, or money made through any apps. Additional income from bank account interest is ok, as long as it’s less than $1500. Income Limits apply above $125K.

Direct File also requires that you set up an account with the IRS. This account allows you to access all tax forms issued to you in one place, for every tax year, which isn’t a bad idea to have access to even if you’re not using Direct File.

Working Families Tax Credit:

Don’t forget to check your edibility for the WFTC! This credit is now in it’s second year of availability and is a state sales tax refund, of sorts, for families based on their income and household size. The maximum credit available for those who qualify is $1,255. This refund will arrive separately from federal tax filings, straight from the State of Washington. Tip: those who use Direct File will be guided to the WFTC at the end of filing.

Filing your taxes can feel uber-stressful. The amount of information can be overwhelming and no one wants to get into trouble with the IRS. If you still need to file, don’t fret—you’ve got options!