Raise your hand if you’ve ever felt like you could use some help figuring out your money! You are not alone!

Where to turn?! Who can help?!

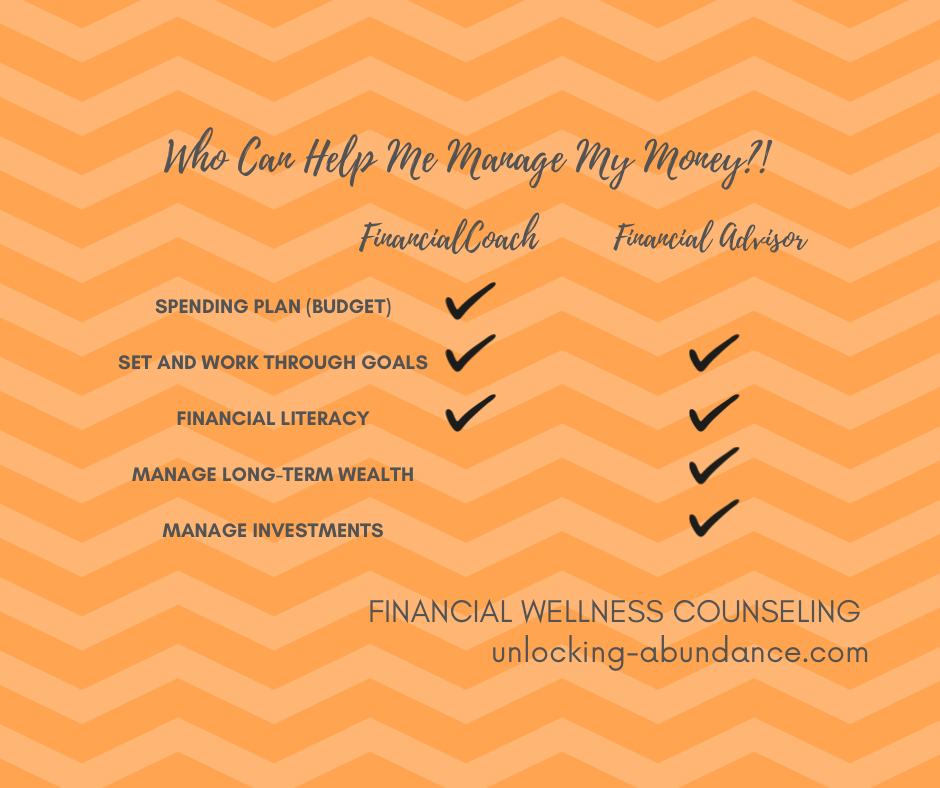

Let’s distinguish between Financial Coach and Financial Advisor, and see which might be right for your needs.

What Is a Financial Coach?

Think of Financial Coaching as within the Life Coaching umbrella, with a specialty on helping you figure out your relationship to, and personal management of, your money.

The best coaches generally rely on great listening skills and empathy in order to fully understand what is going on with you financially. They gather an understanding of not just where you’re at, but where you’d like to be. Coaches are also looking for an opportunity to help you build better financial habits and behaviors. They can generally help with goal setting and “coaching” you along the journey, including how to navigate roadblocks.

They might also teach skills for basic money management, like creating a Spending Plan or paying down Debt. They can provide Financial Literacy, or education, where you’re feeling unsure. They might dive into WHY you feel the way you do, and identify a way to work through both mental or tangible obstacles. They can answer financial questions in general, but will probably back off telling you what you should do. They are less likely to “advise”, but will help you move towards your goal in a collaborative process.

What is a Financial Advisor?

Financial Advisors are financial experts who have a deep knowledge and understanding of different aspects of personal finance.

They might tell you what you “should” do with your money and possibly even manage those transactions for you. An advisor will likely look at your entire money picture, all of your assets and debts, and advise what transactional actions you should do next with your money in order to meet your goals.

They usually work on longer term goals, and might specialize in managing investments, life insurance, retirement withdrawal plans, etc. Depending on their career designations, they might also offer advise around investments, insurance and taxes.

The Most Popular Certifications for Financial Coaches & Financial Advisors:

–Financial Coach

Certification: Accredited Financial Counselor (AFC) requires a comprehensive exam focusing on financial counseling skills and the fundamentals of money management, code of ethics requirement, 1000hrs of experience, continuing education requirements.

–Financial Advisor

Certification: Certified Financial Planner (CFP) requires a bachelor’s degree, a comprehensive exam focusing on fundamentals and in-depth details of money/investment management, code of ethics requirement, 2000hrs of experience, continuing education requirements.

Suggested Questions at any Financial Services Interview:

How long have you been..?

Which certifications do you hold? What are the limitations of what we can/can’t discuss?

Who are your typical clients? What is your Specialty?

How much do you charge, and how?

Are you a Fiduciary? (legally and ethically bound to act in the best interest of their clients)

How will the plan you/we develop be presented to me, and how is progress tracked?

Do you have any references?

Reliable Resources:

Financial Advisor Credibility Check

Find an Accredited Financial Counselor

Find a Financial Advisor