It’s that time again! The IRS officially opened their doors to accept your 2023 tax returns on Jan 29 of this year! Read below for your Filing Checklist—as usual, not tax advice, just some friendly reminders!

Tax Year 2023 Filing Checklist:

Identify Big Life Changes and How They Might Affect Your Tax Liability

–Got Married/Divorced

–Bought a Home or Vehicle

–Moved, Sold a Home

–Had/Adopted a Child

–Started a New Job or Side Hustle

–Got Unemployment Compensation

Gather Personal Data

Identity Protection PIN issued by the IRS (if you’ve even been a victim of Identity Theft) for anyone listed on the return. Social Security numbers for anyone listed on the return, including dependents!

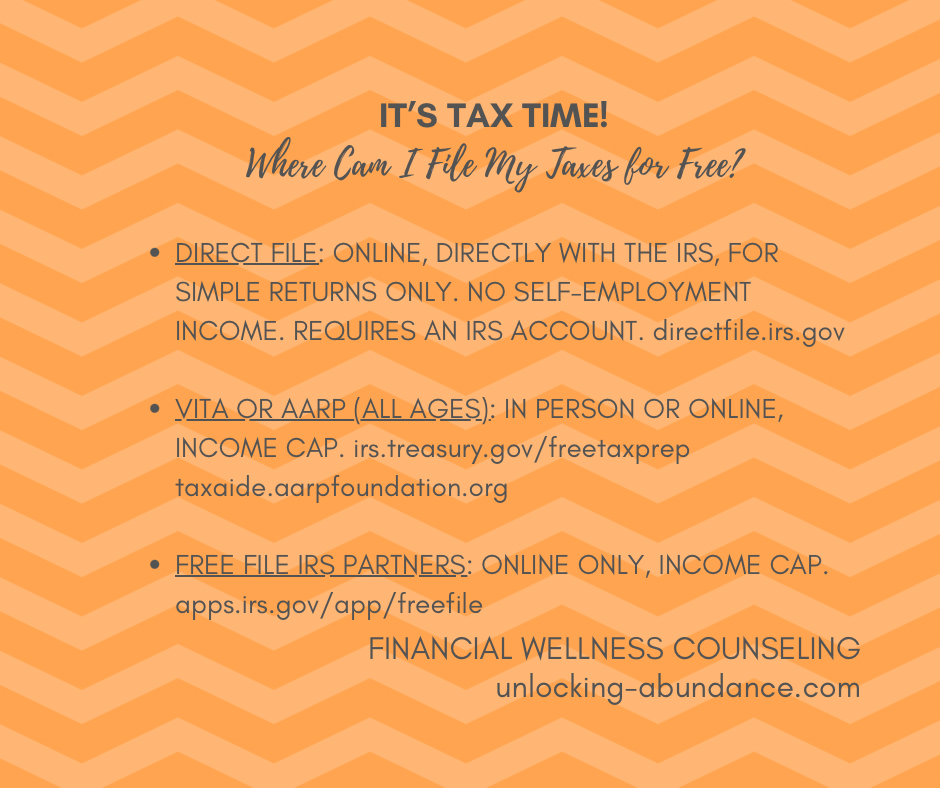

Decide where you will file

Direct File: New IRS Program, online filing, limited to 13 states including WA State. Simple returns only. No Self Employment Income. Requires an IRS account.

Volunteer Income Tax Assistance (VITA): In person and online tax preparer’s. Income cap and some out of scope issues.

Association of American Retired People (AARP): In person and online tax preparer’s. All ages welcome. Income and some out of scope issues.

Free File IRS Partners: Online free software, IRS trusted partners. Income cap of $79k, Adjust Gross Income.

Choose Your Filing Status

–Single: No dependents.

–Married: Jointly or Separately (95% of couples file jointly) There can be some pro’s to filing Separately, see a tax professional.

–Head of Household: Unmarried, with Dependents.

–Qualified Widow: Unmarried, less than 2 years following the year of the death of spouse.

Determine if it’s worth it to “Itemize”

If you think you spent more than the Standard Deduction Amounts (see below) for 2023 on Qualified Itemized Deductions, it may be worth it for you to go this route. If you’re using tax filing software, the computer will probably figure out which option is best for you, but you will need the paperwork that supports what you spent for each qualifying category if you are even interested in Itemizing.

Standard Deduction Amounts for Tax Year 2023

–Single or Married/Separately: $13,850

–Married/Jointly: $27,700

–Head of Household: $20,800

How Did You Receive Money in 2023? A few common tax forms you might receive..

–W-2 from your Employer

–1099G Unemployment Income

–SSA Social Security Income

–1099-R Pension/Retirement Savings Income

–1099-NEC Self Employment/Contract Work

–1099-K Payments Received Working for Gig Economy

1099-INT Interest Bearing Accounts, like a High Yield Savings Account

Did You Have Health Insurance?

If you received form 1095-A, from purchasing insurance yourself or someone else purchased it for you, through the “Marketplace”, you must file this form with your taxes.

Which Bank Account Will You Use?

Bank Account and Routing Numbers are required for refunds/payments when e-filing and using direct deposit.

For Entrepreneurs

–Proof of Estimated Tax Payments made to the IRS.

–List/Receipts of your Qualified Business Expenses.

–Profit & Loss Statement, Balance Sheet, Loan Statements, etc if meeting with a Professional Tax Preparer like a CPA.

Misc. Documents

–Photo ID.

–Last Year’s 1040, if having someone else prepare.

–Proof of additional Expenses you may qualify for: Dependent/Day Care Costs, Educational Expenses/Tuition Costs for Students, Educational Supply Costs for Teachers.

–Proof of Contributions made to Retirement Savings Accounts (if made to a 401(k) through your employer, this info might already be on your W-2).

–Proof of withdrawals made from Health Savings Account (HSA) and the medical expense receipts to back them up, if necessary.

Most importantly, you want to reflect on 2023 as a whole. Recall HOW you made money, and WHAT cost you money. The more money that you can prove you spent on qualified tax-deductible expenses, the lower your taxes may be!