How strong is your Financial Foundation?

Our personal-finance lives are made up of a few key areas of day-to-day money management: Income, Spending, Savings and Debt.

If you’re finding it’s hard to meet your financial goals, or to get clarity on what is going on with your money, it’s worth taking a look at each of these foundational pillars. The intention is to get a grasp of what is going on within each, identify what opportunities there are for change, and come up with a plan for how to maximize results.

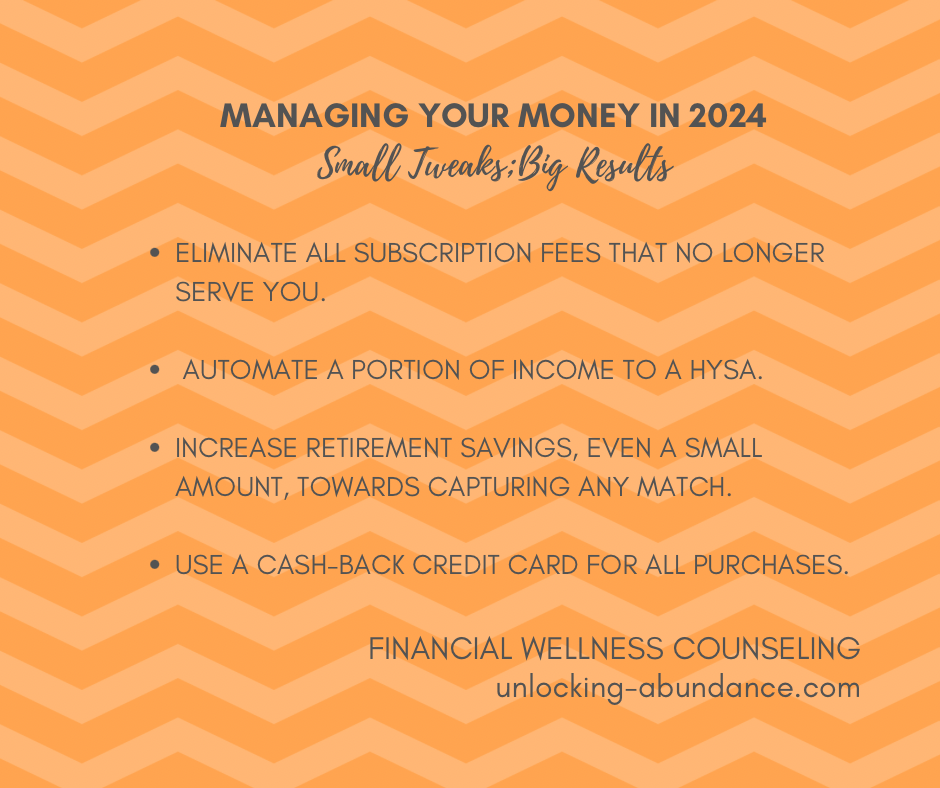

Read below for a few tweaks you can dabble in this year that may offer a big payoff!

INCOME

Tweak:

Are you taking advantage of all the benefits offered at your workplace? You may be leaving money on the table! There may be benefits beyond the typical sick-time, 401(k), FSA, HSA, etc. “Well-being Benefits” are becoming more popular and may offer access to health facilities like gym memberships or compensation for taking extra educational/non-educational courses, financial coaching, or other courses of interest that will give you content for no money.

A Company Match on Retirement Contributions is another massively valuable benefit. Check to see what your employer offers!

Entrepreneur or free-lancer? You can start taking control of your income by making sure that your rates are in line with the competition in your area. Creating a Side Hustle can be achieved by participating in the Gig Economy as well as starting your own small business, or contracting with a larger one. Take a look at your unique skill-set and see who our there could use you.

Makes Possible:

Using your benefits will put money back into your pocket, if you were going to pay for that same service, or it will help you build skills that could translate to a higher salary. Making Contributions to a HSA directly lowers what you will pay at tax time. Capturing any Company Match on Retirement Contributions is a guaranteed 100% return on your money.

SPENDING

Tweak:

On the Spending side, take a look at your last month of expenses (you can do this by looking up your latest bank statement) and get clarity on exactly where your money went. Do an audit of your autopay’s and eliminate any recurring subscription fees that no longer serve you. Everything is a subscription now, make sure you still want what you’re paying for.

Another opportunity to create more cash (on purchases you were going to make anyway) is to use a cash-back credit card if, and only if, you know you can use credit responsibly and will be able to pay the balance off in full each bill.

Makes Possible:

You have the opportunity to redirect any payments that were going to unnecessary subscriptions to be in line with your goals .

Using a cash-back credit card will not only increase your money coming in, but by paying off your bill in full each month, your credit score will increase or stay in a positive range (as long as you pay the bill on time!).

Personal recommendation, not an endorsement: Two universally recommended cash-back credit cards with low/no fees are Chase Freedom Unlimited (earns 1.5% cash back or more per dollar spent) and the Citi Double Cash Card (earns 2% cash back per dollar spent). I personally like the CITI VISA at Costco (only makes sense if you already have a Costco membership) which gives cashback on Gas (anywhere), Travel, Restaurants, and of course Costco purchases.

SAVINGS

Tweak:

Keep your cash in a High Yield Savings Account (HYSA). Choose an account that is FDIC Insured, and you will be covered up to $250,000 per account. This a high-interest, low risk and accessible place to put your cash. A great place for an Emergency Fund, because of the accessibility. Recognize that you are limited to 6 withdrawals from any savings account, per month. HYSA’s are usually online-only banks and the transfer time to get your money may be 1-3 business days.

If you already have an account, or are about to open one, set up auto-transfers. You can “pay yourself first” by having an amount automatically sent the HYSA with every paycheck. Ask your employer about this option or set up your own recurring manual transfer. You pay you, and then you use what’s left over to pay your bills.

Makes Possible:

Even small amounts deposited in a HYSA will add up quickly, with the high interest rates being offered today. With money set aside for emergencies and the unexpected, you can lessen the chances of ending up increasing your credit card debt. You will be able to turn to your own funds, not the credit card.

DEBT

Tweak:

Make a list of your current balances and their interest rates. Use a debt payoff calculator like to get clarity on your timelines. Wanna decrease your timeline? Double down on a way to increase your income above and send that extra money towards your debts!

Prioritize a system for paying the balances down, whether that’s starting with highest interest card or lowest balance card. Consider a 0% credit card transfer. Read the fine print before transferring or consolidating any debt! The fee to do so may be higher than it’s worth to just pay it off slowly, over time.

If you’re in good standing, and have made payments on time, ask your creditor to lower the interest rate on your card. You have options when it comes to creating your own payment plan.

Pay your credit cards weekly, if possible, to keep the momentum going.

Makes Possible:

You can create your own debt-payment-plan! You can have full control of knowing the how much, and the when, and plan accordingly. You can even start to imagine what you might use the money for, once the debts are gone.

The more often you pay your credit cards (weekly, as mentioned) the faster your credit score will increase, as your Credit Utilization (how much available credit you’re actually using) stays low. This works if the payments are made regularly and on time. Paying down your debt and thus boosting your credit score will directly impact your interest rates and eligibility for lending for mortgages, auto loans, insurance rates and more!

Building a strong and sustainable Financial Foundation takes time and effort, and starts with setting aside a specific time to dedicate towards gaining clarity on your personal finances. You can do this by putting an official Power Hour: My Money (or whatever you want to call it that speaks to you!) on the calendar and making a short list of what you expect to achieve in that hour. Don’t over-do it, start with a small task and reward yourself for getting through it.

Go slow, put on some good music, have a beverage. Don’t overwhelm yourself. Once the hour is up—you’re done! Repeat by adding the next Power Hour date to the calendar. Do this regularly and you’ll build a habit of checking in with your finances that’s peaceful and productive, rather than stressful and avoidant.

When you take the time to be mindful about your money, it starts to spill over into all areas of your financial life. You think about things differently and have new intentions and motivations. Each financial decision becomes an opportunity to check on how strong your Financial Foundation is and how this decision might affect it.

How good would it feel to start this year off on stronger financial footing?