As we’re wrapping up another year, here’s an opportunity to reflect on how this year played out for us and our money! Take a moment to think back on both the financial highs and lows over this last year.

By identifying what you want more of, and what you want to leave behind, you can get clarity on what’s possible in 2024! You can do this by taking a bird’s eye view of your current financial picture. Check in with your numbers and, most importantly, how you feel about your numbers.

One way to do this is by checking on the current balances in your Emergency Fund, your total debts, and also by visiting your credit score and credit report, if it’s been awhile. Anything that you can access in just a few moments of time is worth it, in order to understand where you are at, and think about where you want to go.

Evaluating Your Numbers:

–Emergency Fund–

Your emergency fund “should” ideally equal at least 3 months of your bare-bones expenses, or NEEDS. Things you would absolutely have to pay, should you lose your income. With today’s interest rates being as high as they are, interest rate offered in High Yield Savings Account’s are higher than they’ve been in ages. This is a great place to store cash that you need to keep accessible.

There are many online-accounts offering an Annual Percentage Yield (APY) right now of 4% or higher. This means that if you were to put away $100/month for 1 year, you’d have your $1200 saved at the end of that first year, plus an additional $48 in interest, just for putting it there. Little to no risk.

Once this fund reflects 3 month’s worth of NEEDS, or whatever makes you feel secure, you can think about moving that same amount of money you were putting in the Emergency Fund to somewhere it makes even more money, like maybe investing!

–Debt–

Monthly debt payments, including housing, that make up 36% or less of your Monthly Gross Pay are considered to be less of a burden when it comes to reaching our other money goals.

You can calculate your own “Debt-to-Income Ratio” by dividing your monthly Debt Payments by your Monthly Gross Income. For example, if all of your debt payments, including your housing, equal $2500/month, and you bring home $5000/month before taxes, your debt-to-income ratio would be %50. This would be considered a high-burden of debt and it may be the reason you have trouble meeting any financial goals. The solution could be to increase your income, decrease your spending, or both, while prioritizing paying down debt.

–Credit Score and Reports–

A Credit Score above 670 will give you the best interest rates, when applying for a loan or credit. They may also impact your ability to rent an apartment, pay for utilities, etc. You can increase your credit score by understanding the components of the score, and making payments on-time.

A Credit Report that has information you believe to be incorrect must be addressed with either the institution that reported the erroneous information or by contesting it with the credit bureau who created the reports. You have the right to have to an accurate credit report. Consumer protection laws exist in order to protect anyone who needs to contest any information reported in error. This is important because it’s this report that any agency will go to when they’re thinking about loaning you money (they might check your Debt-to-Income Ratio as well!). You don’t want to be penalized financially for inaccurate info.

Visit annualcreditreport.com in order to access each of your three credit reports from Experian, Equifax and TransUnion. The Consumer Finance Protection Bureau (CFPB) is a great resource if you have any trouble remedying your credit reports.

A Few Additional Reflection Questions:

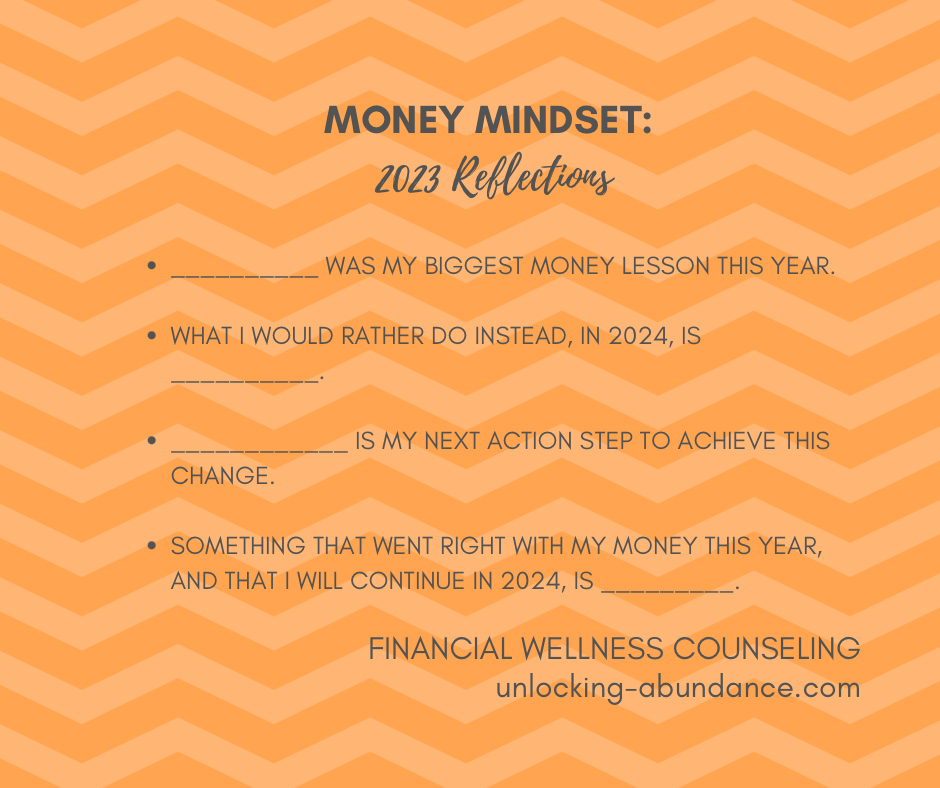

- What Was My Biggest Money Lesson This Year?

- What Would I Rather Do Instead, in 2024?

- What is My Next Action Step to Achieve this Change?

- What Do I Want to Let Go Of in 2024?

- What Went Right This Year, and How Can I Bring that Progress with Me into 2024?

Give yourself a break on the lows, and take time to celebrate the highs! Think critically about WHY the situations went the way they did, and what you can do moving forward. These questions allow us time and focus to reflect on our current circumstances and see if can back-track our way to our thoughts and/or feelings about what we’re experiencing. Circumstances–>Thoughts–>Feelings–>Behaviors–>Outcomes.

What outcomes are you aiming for next year?