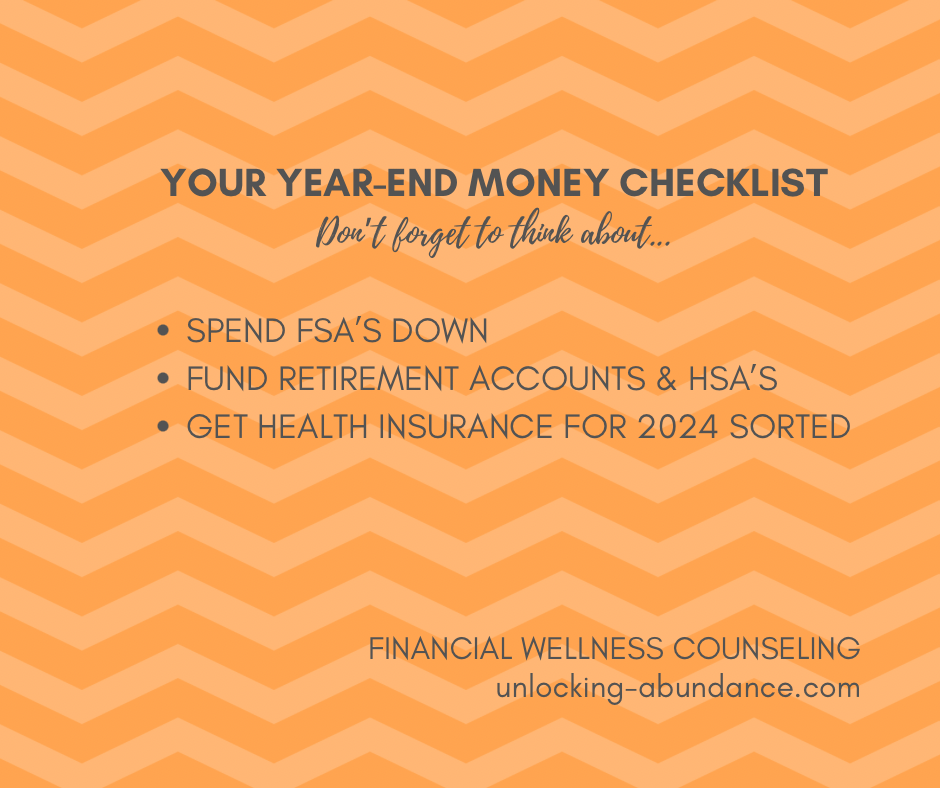

It’s time to close out 2023 (!!!) and with that comes some money moves and/or opportunities for review! Read below for a few time-sensitive checklist items you may need to take advantage of right now!

Reminder: not tax advice, just some friendly financial literacy.

Spend Your Flex Spending Accounts (FSA):

Here is a refresher on what this is. If you are lucky enough to have one of these, take advantage and don’t throw away your hard-earned benefits–especially if you made any contributions throughout the year!

In most cases, FSA’s are “use it or lose it” by year end. Check your employer’s plan for details. Depending on your FSA, you can use the funds for a whole host of supplies you would find at your optometrist’s (eye dr.), drugstore, or online FSA Store for all things qualified shopping. Some FSA’s offer Dependent Care, as well, for children under 13. This includes the cost of pre-school, day care, after school program’s, etc.

Contribute To, or Spend, Your Health Savings Accounts (HSA):

Here is a refresher on what this is. HSA’s are there not only as another vehicle option to grow your wealth, but also in order for you to pay for out-of-pocket medical, essentially tax free! You will never be taxed if you use this money for medical expenses, so whatever your tax-rate is, that’s your savings!

If you want to maximize your account, you’ll want to fund the account by the end of the year. HSA’s are funded by either you, your employer, or both, and the balance in the account does roll-over into the next year. As long as you hold onto your HSA-qualified Health Care Insurance Plan (see more on this below) you can continue making contributions.

2023 HSA Contribution Limits: $3850/Individual and $7750/Family.

Get Right with Health Care in 2024:

Open Enrollment is NOW! There is a limited window for most people who intend to enroll in a new health insurance plan, for coverage beginning in 2024. Check what’s up with your existing plan.

Is it auto-renewing and you don’t need to do anything?

Is it becoming astronomically more expensive, or the benefits changed for the worse, and you want to shop around?

Did you have a major life event and a change in insurance is necessary?

Did you not have coverage at all in 2023, and you’d like some in 2024?

The deadline to enroll for coverage to start on January 1, 2024 is December 15, 2023. For those who enroll December 16 – January 15, coverage begins February 1. Anyone interested in purchasing plans through “The Exchange” should visit healthcare.gov. These plans may have cheaper premiums, income limits, and tax advantages if you qualify.

Individual plans are available through any health insurer (google it) and may be tax deductible for entrepreneurs (ask an expert). HMO plans are typically cheaper than PPO plans, but with less flexibility for who you are allowed to see. Employer-sponsored plans may be available through your work, and premium costs will vary.

Beyond what you’ll pay in monthly premiums, check out the “Out-of-Pocket Maximum” on the plan. That will give you a specific max amount you could actually be on the hook for, should you have a lot of insurance needs, beyond the annual deductible we’re usually familiar with.

HSA qualified accounts (accounts will typically have “HSA” in the name, you may not use just any high deductible account) will have deductibles of at least $1600/Individual, $3200/Families. The higher the deductible, typically, the less you will pay in monthly premiums. HSA accounts may have higher premiums because of the cash-savings benefits and some come with an area to invest.

Check Up on Your 2023 Retirement Contributions:

Review where you’re at with your Retirement Account balances and gauge those against the limits you’re allowed to contribute for 2023.

–401(k) & 403(b) max contribution limits: $22,500/Annually, age 50+ may add an additional $7500/Annually.

–SIMPLE (Savings Incentive Match Plan for Employees) max contribution limits: $15,500/Annually, age 50+ may add an additional $3500/Annually.

–Individual Retirement Account max contribution limits: Traditional & ROTH $6500/Annually, age 50+ may add an additional $1k/Annually.

Some helpful (sometimes-unhelpful) accepted benchmarks for Retirement Savings:

By age 30/1x your annual gross salary.

By age 40/3x your annual gross salary.

By age 50/6x your annual gross salary.

By age 60/8x your annual gross salary.

By age 67 (or retirement)/10x your annual gross salary.

These are typically met by setting aside 15% of your gross annual income, per year, starting at age 25. This can be done through your job and/or payroll service by having them pull the money from every paycheck, or you can set-up automatic recurring transfers in line with when you get paid.

Don’t let the benchmarks discourage you, they’re a mathematical guide created by Fidelity Investments that tells you that if you have “X” by each age, you “should” have close to your current income in retirement, when paired with your Social Security.

What does matter is that you’re thinking ahead about what your specific expenses might be later in life and putting money away where it can grow faster than inflation. Pat yourself on the back if you’re putting away anything at all, capturing any company matches, and then making sure it’s invested once it’s put away!

If you’re not quite there yet..how good would it feel to get going by year-end?