We discussed the different types of Investment Accounts, along with their pro’s & con’s. If you’re still on the fence about whether or not you want to dabble in investing, let’s take a look at the flipside: what we miss out on when we do not invest our money!

Again, not investing advice; this is just some friendly, and hopefully, motivational information!

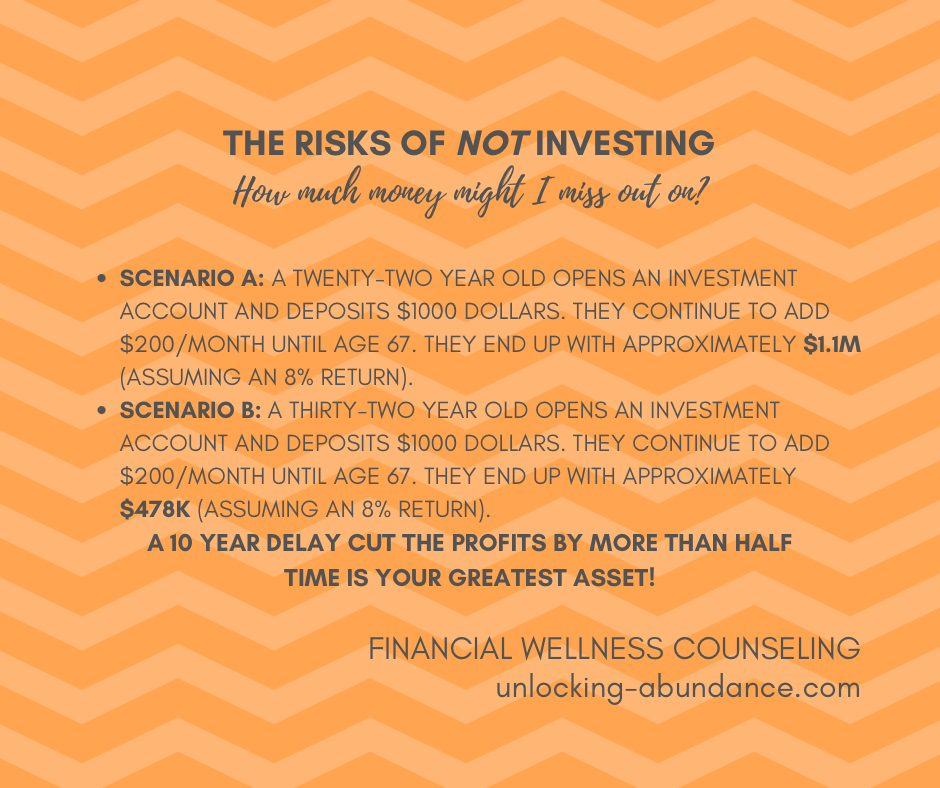

Scenario One: A 22 year old opens an investment account and deposits $1000k. They Continue to add $200/month until age 67. They end up with approximately $1.1M saved. (Assuming an 8% return).

Scenario Two: A 32 year old opens an investment account and deposits $1000k. They Continue to add $200/month until age 67. They end up with approximately $478k saved. (Assuming an 8% return).

Two identical scenarios, except that one person started 10yrs earlier. What these stories represent, besides the crazy amount of actual data in dollars one might miss out on over a 10 year delay, is that time matters more than anything.

Why Does Time Make Such an Impact on Our Money?

One way to appreciate the value of investing over time is to understand something called “Compound Interest”. Here’s how it works, and why you want to get in on what it can do for you.

Official Compound Interest Definition: Compound interest is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods. —Investopedia

Think of the money you sock away in an investment account like a snowball rolling down a hill. The longer the hill, the larger the snowball gets. Same with the money you invest, typically, over long amounts of time.

We might all have some experience with compound interest, without even realizing it. Take credit card bills, for example. This is a situation where compound interest can work against you. If you don’t pay the bill off in full, the balance due incurs interest charges, and if you again don’t pay the next bill off in full, there are interest charges incurring interest charges, and it can be a never ending cycle of increasing debt!

On the investing side, we have the opportunity to benefit from this same type of snowball effect, but in our favor! Let’s say you put $1000 into an Investment Account, without adding anymore money, and your money grow by 6% over 10 years. Because of compound interest, even if you never added any additional money, the interest generated on the account itself would keep the account growing by “compounding” on itself. You could have well over $1800 dollars at the end of the 10 years, having never added another penny, depending on your rate of return.

Why is My Money Worth Less When I Don’t Invest?

Another thing to consider is how costs go up over time and we want to keep up with, if not outpace, those increases. We’ve all heard the word “inflation” a million times now, and probably understand that we’re currently in a time of some the highest rates we’ve seen in decades.

Inflation effects the value of your actual dollar. In a low inflationary environment, the dollar is worth more; in a high inflationary environment it is worth less. Things like groceries become more expensive and you are able to buy less of them with the same amount of money you used to use to buy those same groceries.

When you’re investing, because the returns you might earn often are higher than inflation, your money has the ability to out-pace inflation. Even if you had an amazing goal to have $1M in retirement, because costs tend to go up, your $1M then will be worth less than $1M today, so it’s important to save in a place with high returns.

In short, the value of your dollars will be worth less in the future. So let’s put them somewhere that helps with that. If you’re sticking your savings in a standard Savings Account that’s earning very little interest, great job prioritizing savings but you can certainly think about leveling up with investing.

When you don’t take advantage of investing, you are very likely missing out on more money. This information isn’t to make you feel terrible or deter you from getting started at all. Millions of Americans are missing out on investing! A worldwide study just clocked the USA at 22nd place against a slew of other industrialized nations, as far it’s Retirement Savings. We can do better.

Something like half of Americans report having no savings at all, other than Social Security, to count on once they stop working. Let’s move the needle a little bit as a collective, as well as in our personal lives, and take more control of our outcomes. It’s ok if you don’t have much. Most important is the amount of time you have.

What’s the story you’re telling yourself about why you have yet to invest? Being afraid of what you don’t know is normal, but letting that fear affect you in such an impactful way is something to consider. There’s a saying, “If you don’t invest than your money never starts working for you. If your money never works for you, you’re stuck working for your money.”

Wrap your head around understanding what lack of action may be costing you, and get going!

How good would future you feel knowing that present you took action?