A recent week-long trip to “The Other Coast” was not only a much-needed reset, but an opportunity to share how to maximize your credit card rewards for travel–and any other purchases in general!

While “Sinking Funds” were a great tool in saving up for travel costs, a review of which credit card to pull out and when, in order to maximize rewards before and during the trip was also essential, to maximize savings. Read below for a few tips on how to get the most from your credit card rewards, as well a few recommendations for credit cards with rewards that might make sense for you right now!

How Do Credit Card Rewards Work?

In general, if you make your payments on time, you may be eligible to earn some rewards for every dollar that you spend, depending on the terms of that specific card. The rewards may be paid out in cash, a statement credit to a credit card bill, or as points to use towards discounts on purchases like airline tickets or traveling upgrades.

Credit Card Rewards Specific to Store: Many stores offer their own retail credit card. You will generally get a discount for signing up for the card at check-out and then earn rewards that are redeemable at that specific store, or points when you use the card elsewhere, that can get you further discounts at the store of origin. Example: Nordstrom Credit Card

Credit Card Rewards Specific to Travel: Airlines, as well as travel-related-reward credit cards, offer their own benefits. Purchases put on that card can often be exchanged for points applied to airline tickets, airport lounges, and perks while traveling. Example: Alaska Airlines Visa Signature Card

Credit Card Rewards General Cash-Back Cards: Many major banks offer credit cards with rewards to existing customers. These cards can have cash-back rewards where you are required to pick your saving categories quarterly, and you then get cash-back directly to your bank account, or a credit against your next credit card bill. The burden is on you to be on top of selecting your categories and requesting cash-back when you want it. Example: US Bank Cash+ Visa

How Can I Maximize My Rewards on the Cards I Have Now?

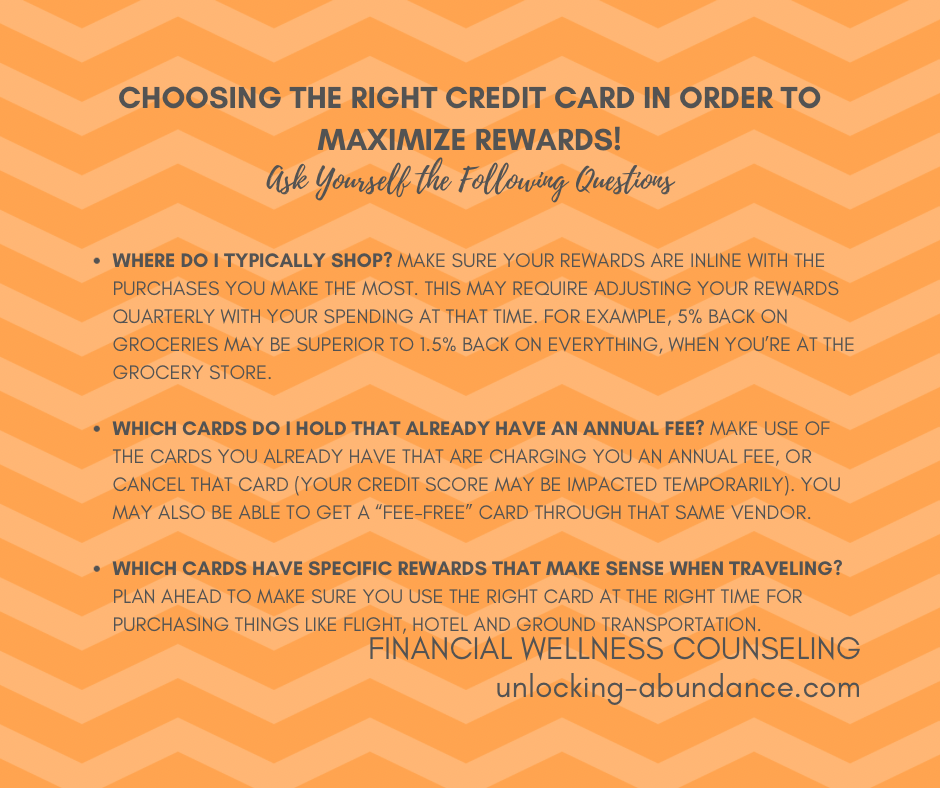

Take an audit of your wallet and see which cards you currently hold and understand the rewards that each offer. Again, you usually must be in good standing as far as on-time payments in order to capitalize on rewards.

Make sure you don’t overlap on rewards. For example, if one card offers 4% back on gas purchases, don’t choose gasoline stations on another card where you have the ability to choose your rewards. Use that card to capitalize on another category, like groceries.

Prioritize cards that already have an annual fee. You want a reason to justify the fee, so you should probably be using that card regularly. Otherwise, consider canceling the card. If you’re worried your credit score will dip because of the cancellation (a valid worry as your credit score may decrease if your “Credit Utilization” and/or “Length of Credit” changes) you may want to call the vendor and ask if they have a fee-free card you can apply for instead. The benefits probably won’t be as good, but you’ll have that credit history.

Which Rewards Credit Card is Best for Me?

The answer is: it depends on where you shop, and what types of rewards you are interested in.

Do you have a favorite place you buy groceries? If you shop exclusively at one store, does the grocery store itself offer a credit card, or can you find a credit card that has cash-back on groceries and commit to using that card every time?

Do you travel a lot using a specific airline? Are upgrades and experiences at the airport important to you? You’ll want to choose a card that focuses on that airline, and it may partner with other airlines you use as well. Alternatively, you’ll want to choose a card with rewards for travel purchases.

How Can I Maximize Rewards for Travel?

Use the proper card that gets you the most rewards when it comes to paying for flights and hotels. Before your trip, also check any cards that have categories you can control and choose the ones you will likely use on that trip. For example, if you’re going somewhere where you will be using a lot of ride-sharing apps, activate “Ground Transportation” to be a highest cash-back category during the time you are travelling, and save on every ride!

What are Some Top-Rated Cards Right Now?

General Purchases:

If you already pay for a Costco membership, you may be surprised to learn about the benefits that the Costco Anywhere Visa provides. Since you are required to pay for the membership to shop at the store, there is no annual fee for this card. The rewards for purchasing Gas (anywhere, doesn’t have to be a Costco station), Flights/Hotels, Bars/Restaurants, and Costco purchases add up quickly. Rewards are only redeemable once a year, in the form of a Costco gift-certificate, but you can have that converted to cash. There is no burden on the consumer to adjust any categories or do any admin work, and the benefits rarely change. Since the rewards are paid out annually, at the same time every year, it’s a good opportunity to create a predetermined use for that cash! Kind of like an annual bonus!

For convenience, check for rewards-cards where you’re already banking. They might have cash-back card for you! The burden may be on you to identify the categories you want to earn cash back on, and you may need to identify them quarterly. The convenience is that as an existing customer, sign-up might be very easy (often with bonuses!) and everything will be connected to where you already bank. Access to all accounts should be easy with online banking all on one screen.

(Personal Disclosure) I personally prefer cash-back-reward credit cards, and am not an expert on the best travel rewards cards, but you can find some highly rated ones through NerdWallet here! Be aware of annual fees, interest rates and your ability to pay off the card in full each month, and that you’re not duplicating rewards you already hold elsewhere!

How good would it feel to be rewarded for the purchases you were going to make anyway?