ICYMI, the “Fed” (aka Federal Reserve who sets the prime interest rates and basically regulates all things finance in the US) announced last week that the rising interest rates we’ve all been experiencing lately will take a pause.

What Does this Mean for Me and My Debt?

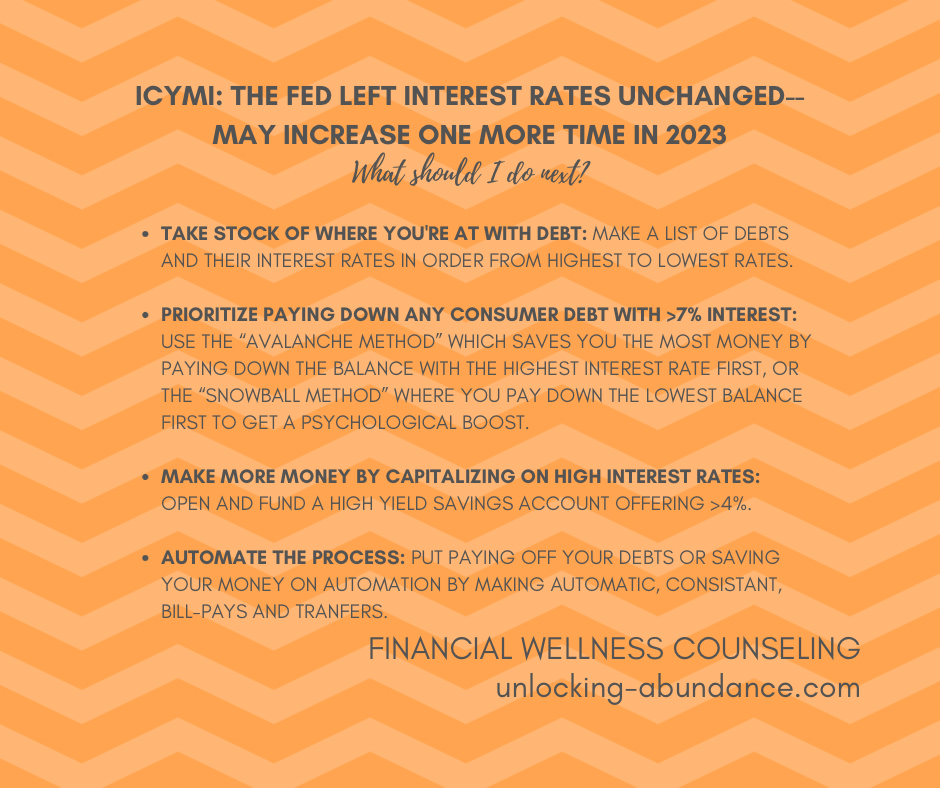

It may be a good time to prioritize paying off high interest debt AND increase your savings, as a way to set a sustainable plan in place that frees you from the cycle of credit card debt.

On the Debt Side:

The prime interest rates directly correlate to your credit card interest rates—meaning, when they decrease, rise, or pause, you can see the same with interest rates on your credit card, usually within just a couple of billing cycles.

Currently, credit card interest rates are up significantly compared to the same time last year–20.44% being the national average. If you’re able, it’s a good idea to prioritize paying down any “high interest debt”–usually determined to be any debt that exceeds 7% interest (this is because once the interest on the debt drops below 7%, you’ll make out better by investing your money rather than using it to pay off debt, FYI). Therefore, if your mortgage, any loans, or student loans are showing interest rates below 7% each, don’t worry about making headway on those debts right now.

OK, I Do Have Credit Card Debt and I Want it to Go Away..Where Do I start?

It depends on the size of your balances.

If you have just a few credit cards and a couple of them have a very small balance, you may benefit, psychologically, by knocking out the smallest debt first. This method, known as the “Snowball Method” (see steps below to get started!) can give you real momentum once you’ve committed to paying off debt, because you get results right away.

If you have 2 or more cards that have rather large balances, you may benefit from “The Avalanche Method” (see steps below to get started!). This method saves you the most money overall, which is advantages if you have a lot of credit card debt, which can accumulate quickly with these high interest rates.

The Methods–A How-to:

Avalanche Method:

Write down a list of all credit cards you hold, in order of Interest Rates, highest to lowest. Pay as much as you can on the largest interest rate card first; this will save you the most money over time. All other cards, pay only the minimum balance due. Once that largest rate card is paid off (this could take awhile, this method takes patience and consistency) pay as much as you can on the next highest interest rate card and repeat down the line.

Snowball Method:

Write down a list of all credit cards you hold along with their balances, in balance order, smallest to largest. Pay the smallest balance in full (or work toward paying it in full) while making minimum payments on all of the others. Once that smallest balance is paid off, move to your next smallest balance and repeat. Use that momentum and psychological hit of seeing a card paid off to keep you on track!

Tip–Other Ways to Lower Your Credit Card Debt:

Contact creditors and ask for a lower interest rate—this is a good option if you don’t have any missed payments. Doesn’t hurt to let them know you’re considering a balance transfer to another company, and would they like to keep your business..?

Consider a balance transfer to a card with a 0% Introductory Interest Rate offer. With these, watch for fees of what the transfer will actually cost you; sometimes the fees outweigh the opportunity if the balance you’re transferring over is quite high and they’re charging you a percentage. Also, consider the length of time that the 0% will be in affect. Create a timeline that works for you to make consistent payments before the offer expires.

Get creative and find a way to keep most of your cards inaccessible! You might consider keeping one on hand for emergencies (if you don’t have an Emergency Fund yet to cover an unexpected expense) but make it really inconvenient to access. Convenience is a huge part of our behavior. Make it hard to use your cards by not saving any credit card details on your computer or phone for purchases.

On the Savings Side:

As the interest rates on credit cards increase, so do the ones in our favor for Savings—just as credit card balances rack up quickly with interest rates as high as they are, our cash reserves can benefit from that compounding effect too.

Interest rates on High Yield Savings Accounts (HYSA) and Certificates of Deposits (CD’s) are higher than they have been in a decade. These types of accounts are both very low risk places to stash your cash and watch it grow.

The Average HYSA is currently clocking 4.39% interest, while CD’s are coming in at over 5%. This is compared to the average HYSA gaining just 1.8% a year ago. For clarification, if you were to open one of these HYSA’s accounts with $1000, you would gain $43 dollars in interest annually, vs $18 in interest annually just a year ago. The beauty of these accounts is that there shouldn’t be any fees and you can access your money very quickly (unless in a CD which has a date by which you can access your money again–that’s why they offer you a greater return). By automating a monthly transfer into a HYSA, you can watch your money grow stress-free. Even an amount as small as $20/month adds up!

Gee, it’s Great to Have these Tools, but How Do I STAY Debt Free Once My Credit Card Balances are Paid Off?

Once you’re out of credit card debt, definately, definately, celebrate and treat yourself on an amazing accomplishment!! And then..think about how you’re going to stay out of credit card debt. This is where the Savings component is most important, in addition to paying down your debt.

For example, if you were to pay off your credit card debt, and then an emergency came up, how would you pay for that emergency? Probably with a credit card; you’re right back into the cycle. If you want to break the credit card debt cycle, you have to come to terms with what you’re using the credit cards for, and imagine what it would be like if you could use your own money rather than a credit card in the future.

An Emergency Fund is exactly for this situation. The HYSA is a great example of where to put money for your Emergency Fund. This fund will accumulate for you, and be there when that unexpected expense inevitably occurs. You will be able to turn to it rather than a credit card. You could aim for 3 months of living expenses, plus a buffer for unexpected emergencies like a medical bill or car repair, whatever makes sense for your life.

How good would it feel to have your own back at your next financial flare-up?