Let’s talk getting back into the student-loan-payment mindset!

What We Know:

Payments on Federal Undergraduate and Graduate Student Loans have been in “forbearance” (meaning “paused” due to the hardship of the Pandemic) and not accumulating any interest since March of 2020. If you have been making your payments all along—congrats! Your balance could be much lower now that you were paying directly towards the principal with no interest accruing for the last 3+ years!

If, like a lot of people, you took advantage of the forbearance and budgeted those funds towards some other needs or goals, it’s time to take a fresh look at your personal Spending Plan and make some choices about where the money will come from in order to begin paying on your loans again. Interest begins accruing September 1, with payments due in October.

Determining Your Payment Amount:

We can’t make the best choices for ourselves without being fully informed. You may have heard about a new opportunity for lower payments through the new Income Driven repayment plan, SAVE, or an opportunity to have your longtime loans forgiven all together thru payments made for at least 20 years, or thru Public Service Loan Forgiveness.

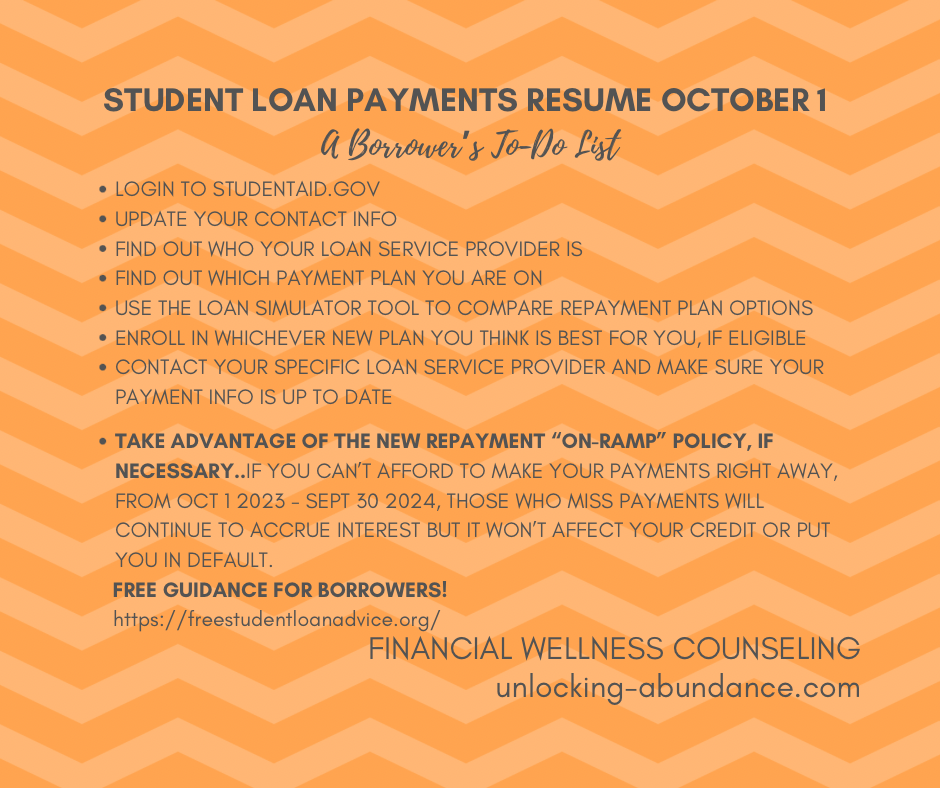

In order to familiarize yourself with your loan situation, as well as see the options available to you, consider the following your Borrower To-Do List:

–Login to StudentAid.gov

–Update your Contact Info

–Find Out Which Payment Plan You are On

–Familiarize yourself with your Loan Providers

–Use the Loan Simulator Tool to learn about Repayment Plan Options

–Enroll in Whichever Plan You Think is Best for You

–Login to your Provider and update your payment information

The Student Loan Payment “On-ramp”:

Again, payments are due starting in October. To make the transition a little less painful, no one will be penalized as quite as harshly for missing payments in the first year (although interest will still accrue). This is due to a new policy the Administration is calling an “On-ramp” to making payments. The On-ramp promises that those who miss payments between October 2023 – September 2024 will not be penalized with being found in default nor will credit reports be impacted or anyone sent to collections. Borrower’s are automatically eligible for this limited time offer.

Still have questions?

The Institute of Student Loan Advisors (TISLA)