We looked at what to keep in mind when considering a divorce, but what if your mind is made up, and/or you’re right in the thick of it? Read below for just a few things to prioritize when it comes to making the best decisions for your finances, and, as always—not legal advice, ever!

There are many reasons that going through a divorce can be stressful and the financial impact is definitely a huge part of that. Where there is uncertainty, there is stress–particularly around money.

One common theme among divorce is that one partner (usually women) get left out in the cold, as far as dividing up assets, because one person had been exclusively taking care of the finances and/or was the main breadwinner (usually men). Often, someone in the relationship can get a raw deal in the divorce simply because they didn’t know their own financial situation, or what to think about when making decisions. Use the few steps below to bring a little clarity to the situation of where you’re at with your money before you start negotiating.

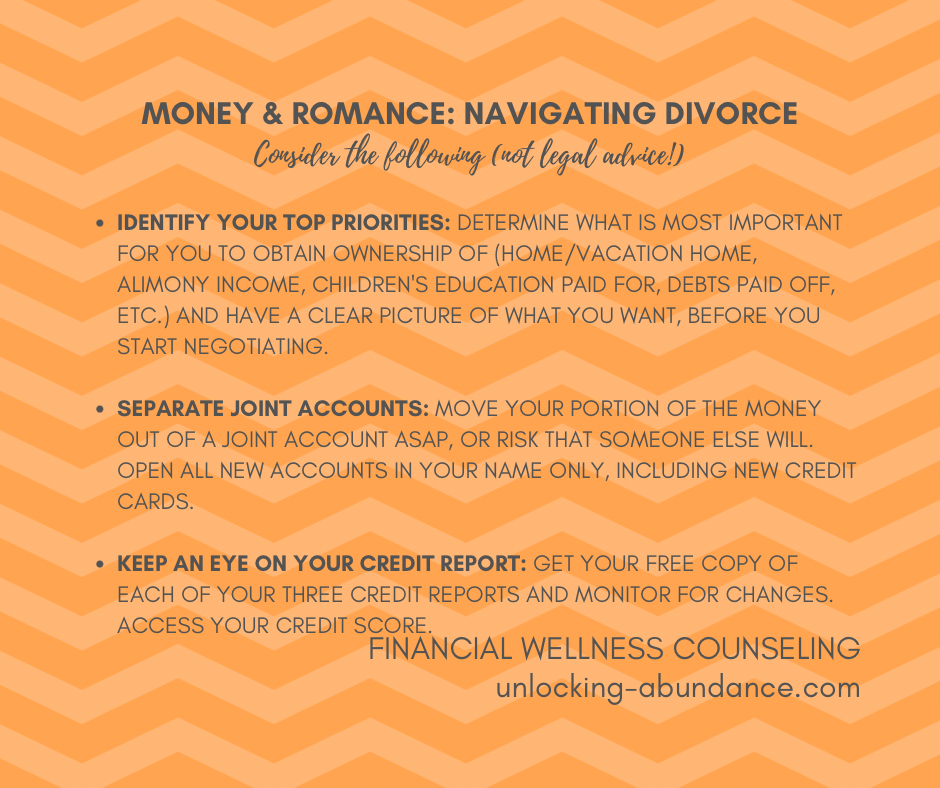

Prioritize What You Want:

Do you want the house? Alimony payments? Help paying for children’s education? Specific accounts? Once you identify what you want, analyze what the asset is actually worth in order to see it’s real value and pitfalls. You can analyze the value of accounts by using current bank statements, and for real estate, by getting a professional appraisal.

Also, consider the tax implications. For example, retirement accounts that are tax-deferred (like 401(k)’s), meaning you’ll owe the taxes later, devalues what it is actually worth now. Real estate may incur capital gains taxes if you were to sell. If you were to keep any real estate, it could require on-going maintenance payments and a harder hit to your budget if you have a mortgage on only one income. If you do decide you need to move, think about using a Certified Divorce Lending Professional in order to get support obtaining a mortgage while going thru divorce.

Move Your Assets Out of Joint Accounts:

When sharing a joint account, anyone on the account can legally drain the funds at anytime; move money that is entitled to you somewhere safe ASAP. Open new accounts in your name only, and new credit cards, if needed. Determine which account you will be pulling from in order to pay for the divorce, if necessary. A Divorce attorney may be able to provide you with a quote on what the process will cost. They may require a retainer fee up front, and then you might be able to set a maximum amount for any extra work that exceeds that fee.

Try to avoid getting saddled with debt by using credit cards, but if you must fund the process with credit (perhaps you want to keep building up your emergency fund during this precarious time) you might want to open a new credit card account with a 0% APR introduction offer, continue to build your emergency fund, and then pay off the card with those funds before the 0% rate expires.

Check Your Credit Reports and Credit Score:

Check each of your 3 Credit Reports, one from each bureau: Experian, Trans Union and Equifax. Look for any errors or inaccuracies, as well as accounts you might not have even known about that you may or may not be legally responsible for. Continue monitoring your credit proactively throughout the divorce process. You can check your score for free at creditkarma or creditsesame.