Continuing down the Money & Romance rabbit hole..what are the financial implications to think about when considering a divorce?

Since statistics have shown that, post-divorce, women experience a significantly larger decrease in their standard of living than men (thank you, Wage Gap!) it’s important that they advocate for themselves and their financial outcomes wholeheartedly thru this process.

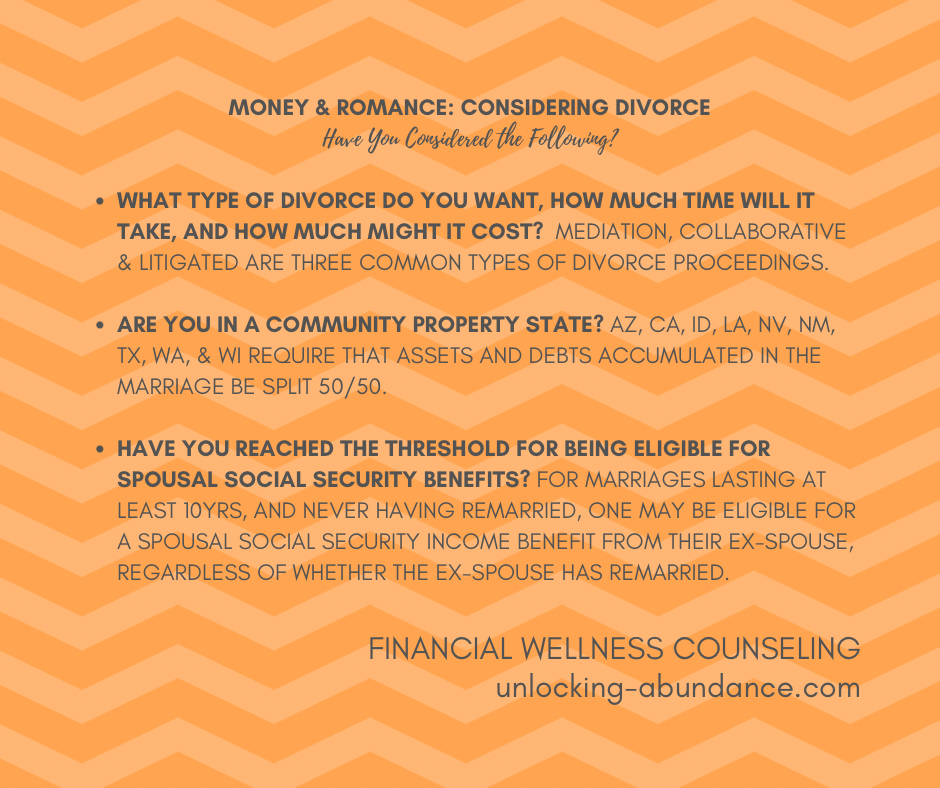

Whether you’re just curious about, or seriously thinking about initiating a divorce, read below for a few things to consider before heading down that road that could save you a lot of time, money and energy.

Consideration #1: Which Type of Divorce Makes Sense for Me?

Mediated, Collaborative, and Litigated are three common types of divorce proceedings.

Mediation is typically the most cost-effective because lawyers are not required (even though you may want to consult with one anyway). It’s a good choice for amicable (non-hostile) divorces because you don’t have anyone “fighting for you” like an attorney would but, instead, a professional neutral third-party or “mediator” presides over and educates each side (although doesn’t advise like an attorney would) and helps both parties negotiate their way to a settlement.

Collaborative divorce proceedings happen with an attorney for each party and a commitment to reach an agreement. Again, a good options for amicable divorces. The attorney will charge a fee and will be present at the proceeding to represent their client.

Litigated divorces (just like they sound) go through the court system, and can be necessary for splitting up assets, custody, and representing each party aggressively and expensively. They can also take more time than the other two options.

Consideration #2: Where Do I Start as Far as Getting My Financial Life Organized?

You can start by building your team (Financial Advisor, Attorney, Therapist, etc.) and collecting the documents that they advise. This could be bank and credit card statements, tax returns, mortgage and other asset paperwork, etc. You’ll probably also want to verify your credit score and review your credit report (all three!) for any accounts you may be forgetting or uncovering any you may not have known about.

Depending on whether you live in a “Community Property State” or not (AZ, CA, ID, LA, NV, NM, TX, WA, WI are all community property states) will help to determine what assets you’re entitled to, and what debts you may be stuck with, before things even get underway.

Consider how your lifestyle might change, depending on what you think your income might look like post-divorce, and work with a professional (if necessary) to decide which assets make the most sense for you to try to obtain (ie staying in the house you’re living in vs. taking a cash payout, or retirement savings bank account may take some serious analysis to make sense of) and also the tax ramifications on the assets you are interested in.

Consideration #3: Where are You on the Timeline of Collecting Spousal Social Security?

If you are married for at least 10 years or longer, and you don’t get married again, you can get the spousal benefit off of your exe’s Social Security Income, once you are at the age to claim. This benefit is available to you even if your spouse has gotten remarried. Therefore, if you’re very close to 10 years in, and that benefit is important to you, you may want pass the 10 year mark before filing for divorce.

Helpful Resources:

Find a Certified Divorce Financial Analyst or pick up a book by one “The Fiscal Feminist: A Financial Wake-Up Call for Women”. You got this!