Married Couples.. To Combine Finances or Not to Combine Finances? What’s the best way for YOU BOTH to manage money in your relationship?

You’ve got options! Once you’ve had an oh-so-important initial money history convo, shared common goals, disclosed debts, etc. it’s time to move on to the technical aspects of how you will manage the money together (or separately) moving forward.

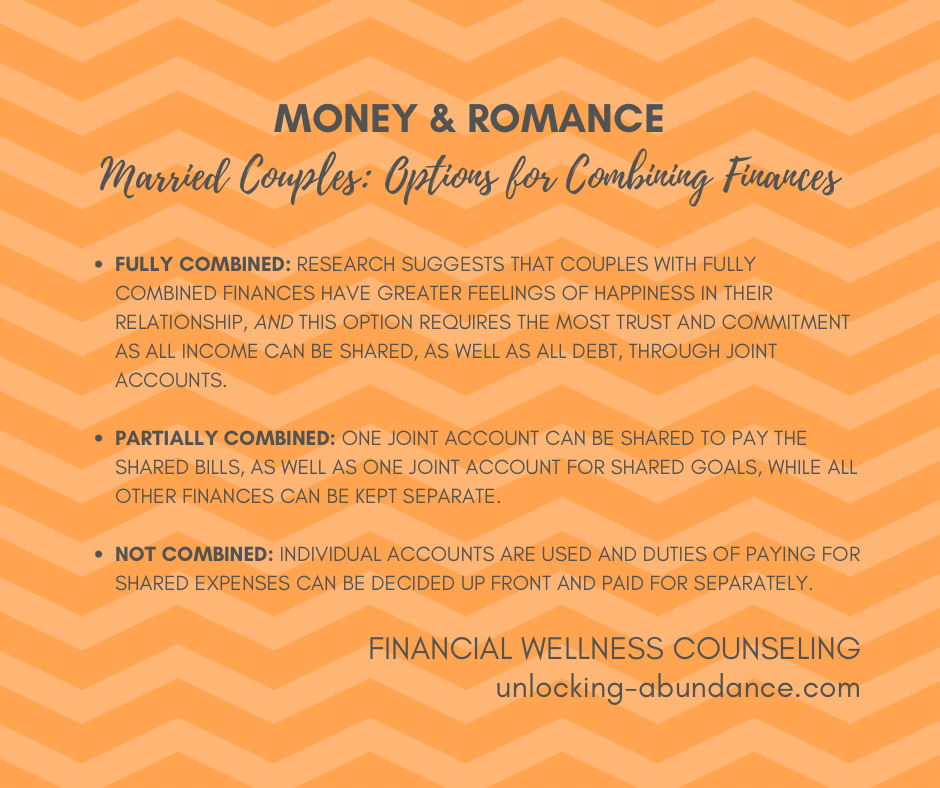

The three options presented here are: Fully Combined, Partially Combined, and Kept Separate. Each option requires (at bare minimum) a conversation in order to identify shared fixed expenses, and an agreement to a sustainable plan. Read below for a few pro’s and con’s of each.

Fully Combined:

A study from Indiana University actually showed that “married couples who share a bank account fight less over money, feel better about their finances, and actually have better relationships”. The communal sharing and working together towards common financial goals as a team seems to lead to greater satisfaction and less disagreements pertaining to a subject that a lot of couples fight about most: money.

This option does require joint accounts on all checking, savings, credit cards, etc., and an understanding of your state’s law’s over those accounts. Once you’ve identified the shared expenses that will be pulled from the joint checking account, as well as shared goals you both can contribute to in a joint savings account, it’s best to automate every step of the process. Everything can, and should, work for you behind the scenes. Bills can be paid automatically from Checking, goals can be raised automatically from paychecks coming in. Then, you and your partner can stay focused on watching those accounts (or assigning who will watch the accounts) and build wealth together.

This method also requires the most trust and transparency. For example, it’s very possible that either partner could have legal access to drain any account whenever they want, no questions asked. That also applies to the racking up as much debt as they want, no questions asked. These issues are what’s known as “Financial Infidelity”.

One way to avoid getting into this situation is to set a “Spending Rule”, such as choosing a dollar amount at which a conversation is required before the (non-essential) purchase by one party is made. It could be $100; it could be $500. Whatever the amount, it should be relevant to the budget and agreed upon ahead of time as reasonable for both people.

Partially Combined:

Again, this method can be motivational to act as a team, because it has a shared goals building wealth component. But also, you can dip your toe into the “fully combining” experience, while still holding a lot of space, autonomy and control as an individual.

This could look like a single joint-account to pay for shared fixed expenses, while paying separately for each of your fun stuff. You can also take it one step further and identify your shared goals and how much each person is able to contribute to one joint High Yield Savings Account (HYSA). Make sure to automate your deposits!

While this method offers less risk and liability than fully merging all finances (including debts) don’t forget to consider that those joint accounts can be drained by either party, at any time.

Kept Separate:

This is the less of the personal-financial-risk and liability option of the three and you’re more likely not to have any Financial Infidelity creep up. Everything is kept completely separate and it is decided up front who will pay for what from their own accounts.

You may miss out on those team-building feels. If those are important to you, no shame in communicating to your partner your preference for how you want to share the finances and why, and then keep an open mind to their response. Explaining the WHY on both sides can make a huge difference in fostering understanding.

Bottom Line: there is no “right” way to share finances in your relationship; most important is whatever works best for you as a couple and there are many, many other ways to get creative that work wonderfully.

For example, you can share the expenses equitably (inline with income), you can have an agreement where one person pays for fixed items and one person pays for the fun stuff, or one partner may solely funds the emergency and the other pays the bills. One person may be the sole bread-winner and compensate the other for labor. These all exist.

If you’re thinking about giving these (or another new option) a try, set the mood for a “money date” at your favorite snack spot, or at home set the atmosphere with your favorite music, lighting etc. Set your goals for the meeting ahead of time and stay on task. Make it enjoyable and fun and keep the focus on the shared experience and meeting your goals together, no matter how you pay for it. You can retain autonomy, even with shared finances, as long as you’re in an environment of honesty, trust and transparency.

Tip: If the conversation goes off the rails and anyone’s hackles come up, return to curiosity and vulnerability about the ideas around money we all bring to every relationship. Most important is that you remember that you are in fact a team in all areas of life, including finance.