The Summer Solstice is here! If you’re lucky, along with these longer nights, perhaps you’re engaging in some new summer lovin’ as well, so what better time to touch base on money & new relationships! If you find yourself spending a chunk of time (and money) with any new peeps in your life, read below on how to have those “what’s your deal with money” and “who’s-gonna-pay-for-what” conversations now.

While there is no “by date number X you should be talking about money” hard and fast rule, you will notice when your spending habits change and it becomes relevant to bring attention to your new situation. THIS is the best time to talk about your finances together (i.e. before bad habits get set in stone and anyone gets awkward or resentful).

Because our financial security is rooted in our feeling of safety talking about our personal finances can be hugely triggering, but it’s essential to have open and honest conversations early, to set yourself up for success! A few tidbits below will help you navigate talking about money with anyone new.

The Getting-to-Know-You Part:

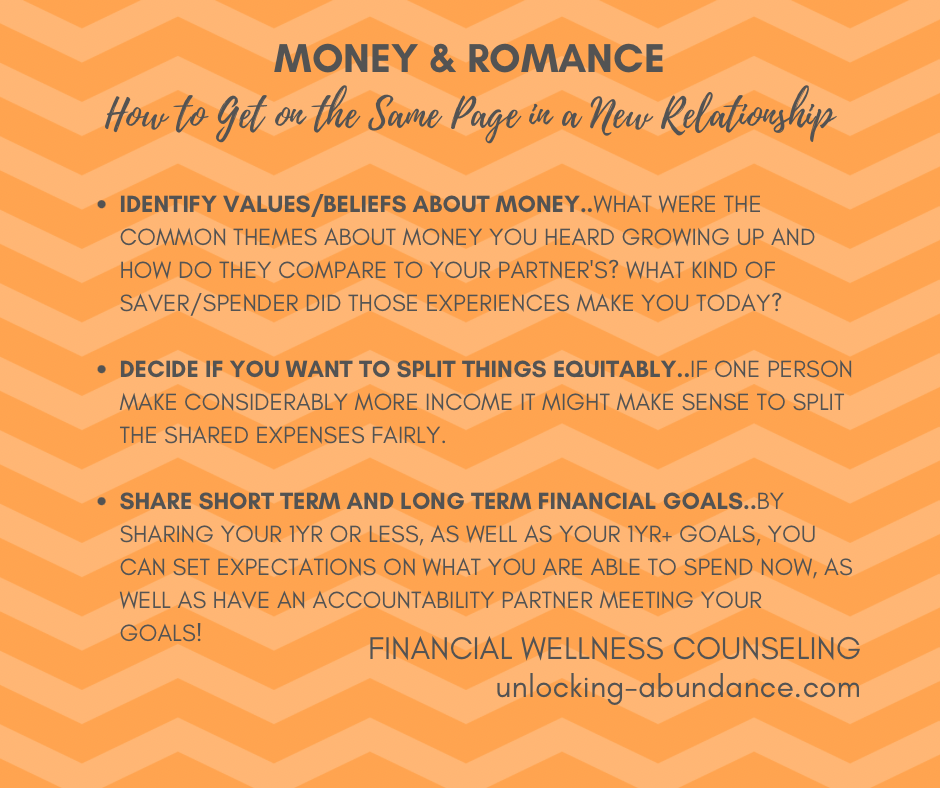

A great way to get to know someone more deeply is by sharing your values and beliefs about life in general, but also, specifically, money. This looks like identifying what your money-beliefs are and how those affect you today. Which money type are you: Saver or Spender? What do you enjoy spending money on, and why? What were the themes in your home around money growing up? How did those stick with you, or did they?

Sharing the answers to these questions and listening to what the other person has to say on each topic will not only help you get to know someone better, but understand their motivations and WHY they do what they do when it comes to money. Fully understanding the “why” behind someone’s behavior can cut way down on judgement and criticism. Get genuinely curious here, use active listening, and even paraphrasing back what you heard before commenting can help to make sure you’re both heard correctly.

The What-You-Do-with-this-Information Part:

When you’re spending time with someone new, you’re likely going to spend some money that you weren’t before. Inevitably, this leads to what can be an awkward “who is going to pay for what” conversation.

If it’s obvious that you make different amounts of income, and you’re interested in being equitable (equal), one way is to split shared bills in line with the amount of income each person earns. This could look like a 60/40 split, 70/30, or whatever the math looks like for you. You can also get creative if one person is doing more of the commuting, heavy lifting in certain areas, etc. Most important is that the agreement is acknowledged and that it works for everyone. Again, communication is key here. It’s preferable to address these situations the moment the issue comes up, and you can quickly lock in your plan.

The Moving-Forward-Part:

Identifying your individual financial goals, both short term (less than 1 year) and longer can help in setting expectations and making good choices together and as individuals when looking towards the future. Talk about your goals, what your financial priorities and existing obligations are, what they cost you, and how you plan to pay for them. You’ll know what to expect, and perhaps even find an accountability partner to keep you on track!