ICYMI: WA State “WA Cares” Long Term Care (LTC) Insurance premiums, which had a short life and since have been on pause since 2022, will resume being pulled from paychecks starting July 1 2023.

Read below for a reminder on what the program is, and how much you will probably be required to contribute, if you’re on someone’s payroll.

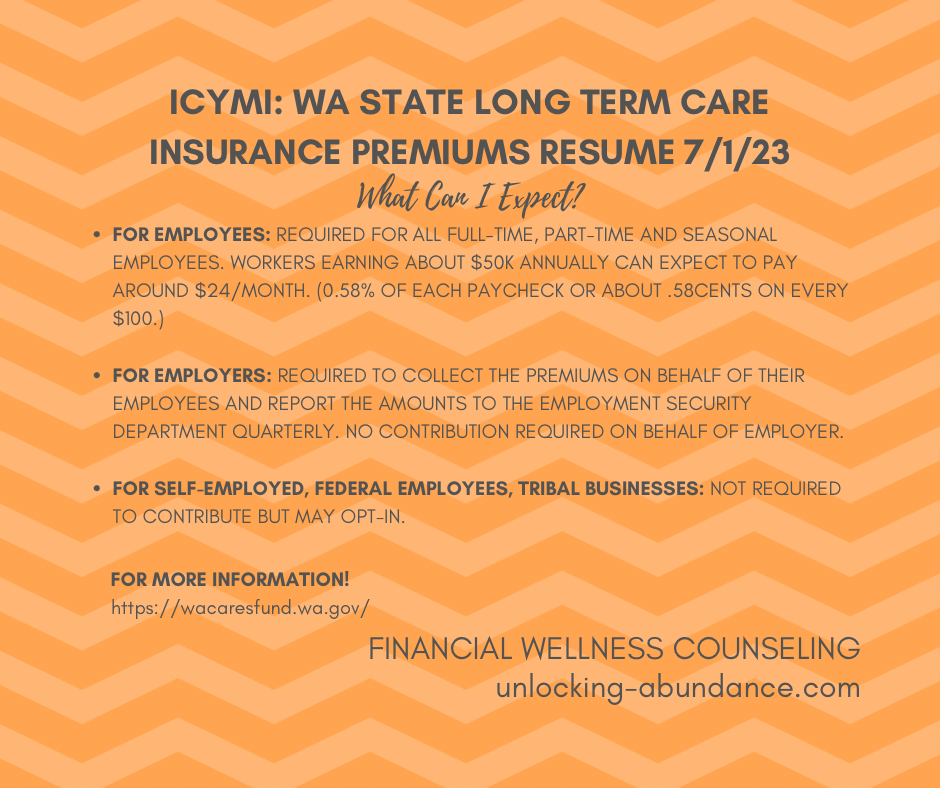

The Details: For WA State residents working full-time, part-time and seasonally, if you are on payroll and do not have your own Long Term Care Insurance (the opportunity to show proof expired in 2022) premiums will resume this July.

The Long Term Services and Supports (LTSS) Trust Act was signed into law in WA State in 2019 and all employees (does not apply to employers or self-employed) will see the tax deducted from their pay. The tax will continue to be deducted as long as you earn a paycheck. (Note: this tax is different from, and in addition to, WA State Paid Family & Medical Leave Policy and also Paid Sick Leave.

The tax will be up to .58 cents on every $100 earned. For example, someone earning $50K annually can expect to pay about $24/month.

The money you put aside into the fund can be accessed after 10 years of contributions (less if you’re nearing retirement or have a sudden need) only for “long term care” related expenses that qualify (Google these—think hiring a care-giver, receiving care in a facility, or many other extremely costly health-related needs like a prolonged illness or injury, etc).

“Long-term care is not medical care and it’s typically not covered by health insurance or Medicare.”–WA Cares Fund website. The thought behind this legislation is that worker’s can put the money away while they’re working, rather than draw on their own personal assets (social security income, retirement savings, etc) while living on a fixed income, when the time comes–which it will.

For Employers: Employers are required to collect the premiums on their employee’s behalf, but no contributions are due on their end. All contributions will be reported to the Employment Security Department on a quarterly basis.

For Self-employed Individuals and Tribal Business Employees: Self-Employed workers and Tribal Business employees are not required to contribute to the program but may opt-in.

For Federal Employees: Federal employees are not required to contribute (see spouse exemptions below).

Want to opt out?

You may apply for an exemption if you meet any of the following:

–You work in WA State but your primary residence is in another state.

–You hold a temporary Work Visa as a non-immigrant.

–You are the spouse/domestic partner of an active-duty service member.

–You are a disabled Veteran.

Once you opt out, you can never opt back in. The opportunity to have exemption due to your own private insurance expired in 2022. For more information, click here.