Following up on a recent post, let’s take a look at how the Debt Ceiling issue shook out!

Read below for a reminder of the options available, what actions were taken by our leaders in government, and (most importantly) how we all, as laborers in the US, help fund these decisions.

As previously discussed, the options regarding the debt ceiling were to come to a deal to increase it, or go into default (not be able to pay the country’s bills). Going into default had some devastating, globally impactful consequences. On May 28 President Biden and Speaker of the House Kevin McCarthy struck a deal that would (temporarily, at least) keep the country from going into default. The deal quickly passed the House (314Yay-117Nay) and then the Senate (63Yay-36Nay) on May 31. As result, on June 3 (just two days before Treasury predicted we would have exhausted all funds!) Biden signed the Fiscal Responsibility Act of 2023, putting spending limits and agreements in place for 2 years.

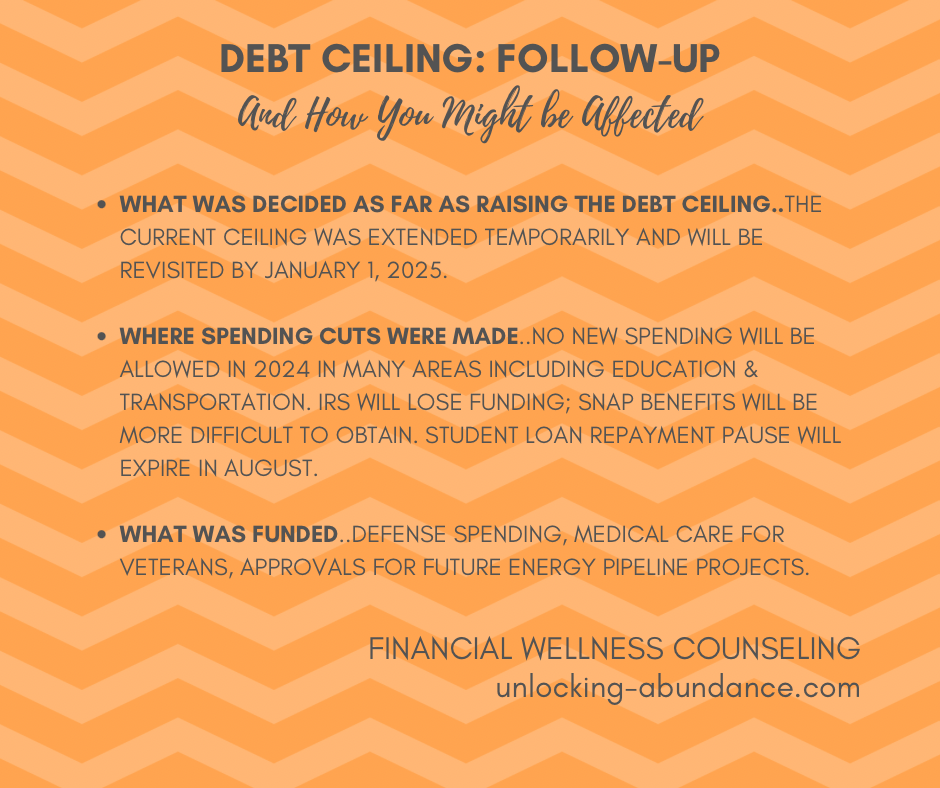

Here’s What was Decided:

Raising the Debt Ceiling: The debt ceiling was raised temporarily (or extended, rather) for 2 years only, thru Jan 1 2025. The decision was made that rather than raise the ceiling indefinitely as has been happening since the early 20th century, it will stay currently capped at $31.4T and talks will be revisited after the new deadline. It’s worth noting the deadline date that was chosen is beyond the next Presidential election, so we’ll possibly have a whole new Administration revisiting this issue in 2025.

Spending Cuts That were Agreed To and Who is Affected:

There is a new cap on non-defense (non-military) spending thru 2024 affecting law enforcement, forest management, scientific research, education, transportation and others. Furthermore, all spending is limited to not exceed a 1% growth in 2025 (interestingly, well below inflation rate right now). $80B which was previously approved to support maintaining and expanding/updating the IRS in the recent Inflation Reduction Act will see $20B being taken away. The work requirement age to receive Food Stamps through the Supplemental Nutrition Assistance Program (SNAP), a federally funded benefit to low income individuals/families, increased from age 49 to age 54 for those living without children at home. The pause on Student Loan payments that’s been in place throughout the Pandemic will be lifted, and not re-extended again, beyond August of this year.

Additional Funding That was Agreed To and Who is Affected:

Defense spending will increase by 3% to $886B in 2024, followed by $895B in 2025. Medical care was expanded for Veterans. Unspent Covid Relief funds of $30B will be redirected to some non-defense spending. Energy projects such as the Mountain Valley Pipe Line to push natural gas through the Appalachian country-side were green-lit at the cost of $6.6B.

How All of this Impacts You, Directly or Indirectly:

We all know that we live in a Democratic Republic where rather than a straight-up majority vote, we use democracy to elect leaders to make decisions on our behalf, reflecting our best wishes and interests for the Country. What we might lose site of once in awhile is that it’s with our, the taxpayer’s, hard-earned dollars that these leaders are able to make the decisions of what will or won’t be funded.

What do you think about these decisions that were made, and what do you think about what is happening with your dollars? The truth is, the people really do have the power and we can speak not only with our vote but with our money. Who we support, what we purchase, and from which companies, is all a reflection of our personal values.

What We Can Do Now:

One of the most important things we can do is identify what is within our control. One way to exercise the amount of control we have is by becoming aware of our financial contributions to the entire system. We can, specifically, determine how much the government has access to, through our tax withholdings. By analyzing our paychecks, or our situation at tax time, we can see just how much of our own money is going directly to the Federal Government all year. On our paystubs this would be on the line item “Federal Income Tax”. There we can see the tangible amount the government is taking, as an interest free loan all year long. You can decide what you feel about this amount, and if you want to adjust the amount and not receive such a large refund at tax-time (if that’s been your situation) you can read more about that option.

Ask yourself: were you aware just how much you’ve been contributing from your own paycheck, and are you ok with that?