ICYMI, as an update to a prior post, as of April of this year, paid medical debt is no longer allowed to continue to be included on our credit reports! This is important because, previously, even paid-off medical debt could affect credit reports (and thus credit scores) by lingering for years!

Read below on why this change is so impactful, how to check your credit report for free, and a refresher on lowering your credit score!

Why this Change to Credit Reports was Needed:

The No Surprises Act of 2022 provided much-needed transparency in the medical billing world. It allowed patients to understand In-Network from Out-of-Network charges, right up front, when getting emergency care. Understanding these costs is important for avoiding massive, life-changing bills, of which medical costs make up a huge portion.

As result of this bill, the three main credit bureaus (Equifax, Experian and TransUnion) removed all paid medical debt from credit reports, as well as those medical bills paid that are less than 1 year old. Furthermore, medical collections under $500 will no longer appear on credit reports at all, as of April 2023.

The Consumer Finance Protection Bureau (CFPB) estimates these changes could help roughly half of the 41M people found to be affected, in 2021, of having inaccurate information or previously paid for medical debt lingering on their credit reports. The information on our credit report directly corresponds to our credit score, which can affect the ability to access everything from decent terms on loans, credit cards and housing.

How can I Check My Own Credit Report to Make Sure it’s Accurate?

At AnnualCreditReport.com you can check your credit reports for free. Make sure you check all 3! Equifax, Experian and TransUnion. You’re looking for any inaccurate information, as well as any medical debt showing that has been paid off. The CFPB website has specific tools and is an excellent resource if anything looks amiss.

How Can I Raise my Credit Score Right Now?

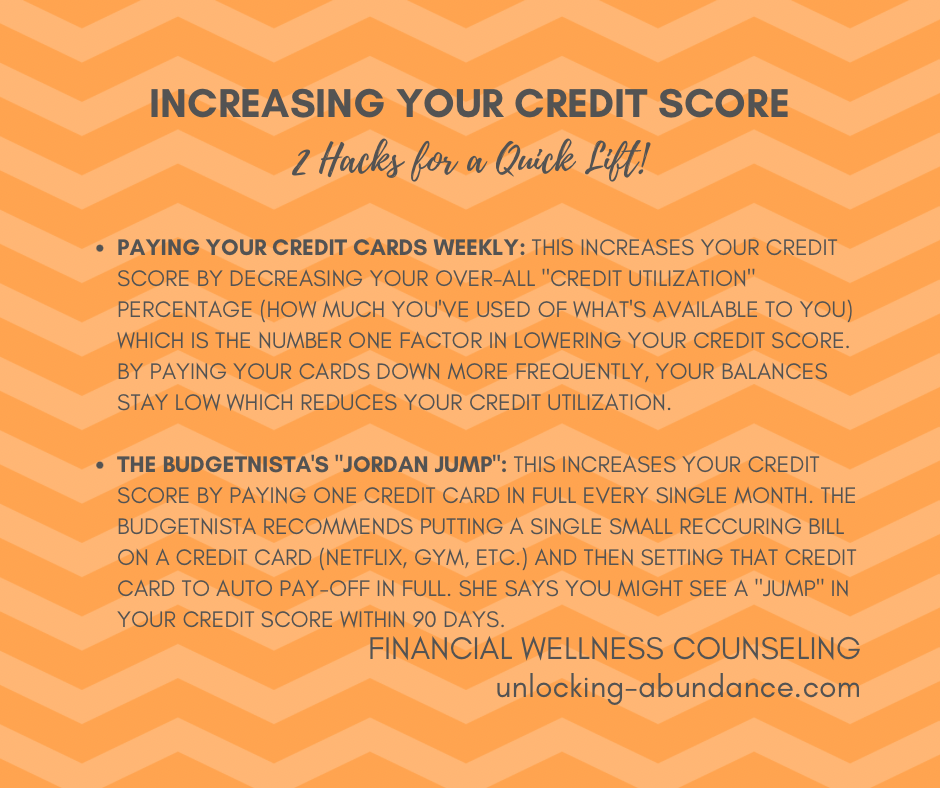

Your credit score is comprised of a few main factors. After Payment History (meaning, whether you paid your bills on time) the next most-impactful factor is your Credit Utilization Percentage. Your Credit Utilization is calculated by comparing the current balances on your credit cards to the total amount allowed. In other words, how close you are to maxing out your credit cards at any given time. The credit bureaus like to see that you’re using less than 30% of your maximum available credit, at whatever time they decide to check up on you.

One way you can lower your Credit Utilization is by paying your credit cards more frequently. By making payments more often, your balances stay lower. You can test this method by paying your credit card bills weekly (as long as your budget allows for it) go ahead and pick a day such as, “I pay my credit card bills on Fridays” making it a routine, and then check to see if your credit score has improved within 90 days.

Another tried and true hack for lowering your credit score created by financial expert, “The Budgetnista”, is what she calls the “Jordan Jump”. With this method, you may see a “jump” to your score within 90 days.

What do you have to lose?