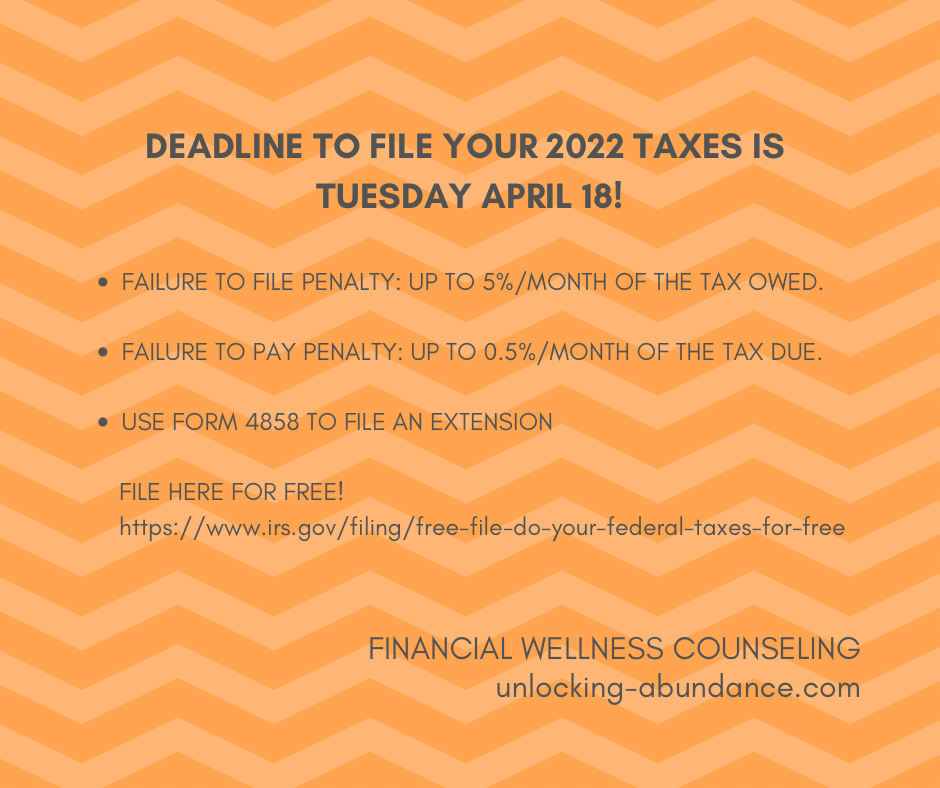

This year’s tax deadline is just around the corner! In order to file your 2022 taxes on time, the deadline this year is Tuesday April 18!

A few important reminders and an overview of penalties.

Who has to file?

Taxpayers under age 65 with a total income (from all sources) of at least $12,950 and Married/$25,900.

What about my side hustle income?

Earnings from a self-employment of over $400 must be reported. Don’t forget to deduct your qualified expenses!

What if I don’t report all of my income?

If you are audited (even several years later) the Failure-to-Pay Penalty can be assessed as much as 0.5% of unpaid taxes due, per month, after the return was due. You could also be subject to an Accuracy-Related Penalty equal to as much as 20% of the under-reported amount.

What if I don’t file.. at all?

The IRS has a Failure-to-File Penalty which can be assessed up to 5% of tax amount due, per month, since it was due. FYI, the IRS has the ability to charge interest on all penalties as well, so these costs can really add up!

What if I owe and don’t have the money to pay?

The IRS has different payment options. You can go to irs.gov and click on “Make a Payment” for more information. You may qualify for an installment agreement or an “Offer in Compromise” which is available to those who have proved they do not have the means to pay.

What if I need more time to file this year?

Your best bet is to file for an extension at https://www.irs.gov/forms-pubs/about-form-4868 before the deadline. However, even though the filing deadline is increased, the money is still due now. You’re simply avoiding the Failure-to-File penalty which, at 5% per month, can really add up.

In summary, do your best to report all income, on time, and use the tools available if you have any anxiety about your ability to pay! Let’s go!