In the wake of bank failures recently, how secure are you feeling with regards to your money? Read below for a touch on your options when it comes to insurance at your institution, as well as a refresher on low-risk options to stash away your cash, for use when things get tight.

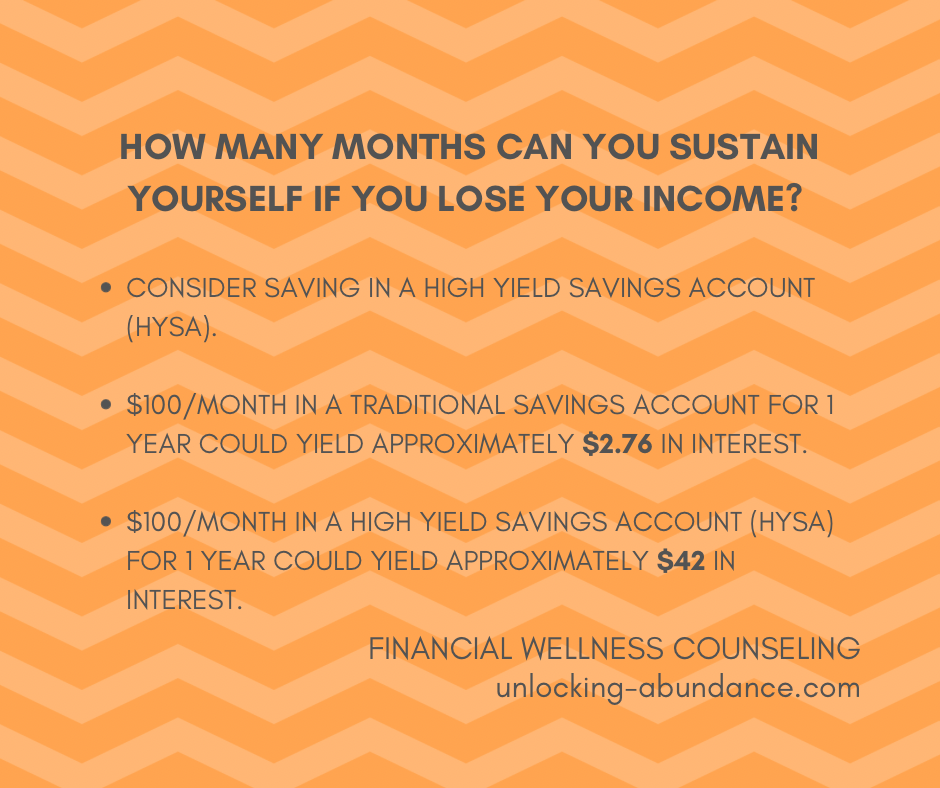

Find out how much a High Yield Savings Account (HYSA) can really “yield” for you in terms of dollars these days, versus a standard Savings Account, and how quickly credit card debt can accumulate if that’s where you turn in a crisis.

Insurance on Your Money by Institution Type

Banks:

Federal Deposit Insurance Corporation (FDIC) on single account holders up to $250k/account or $500k/jointly, per insured institution. You do not have to file a claim to get reimbursed.

Credit Unions:

National Credit Union Administration (NCUA) on single account holders up to $250k/account or $500k/jointly, per insured institution. You do not have to file a claim to get reimbursed.

Brokerage Firms:

Securities Investor Protection Corporation (SIPC) on accounts up to $500k, with cash holdings covered up to $250k. The burden is on you to file a claim to get your money back.

Handy tool to check out your coverage: FDIC Insurance Estimator.

Now that we’ve touched on the coverage available in a national banking crisis..How are you covered within your own personal economy? How impactful would it be to miss, say, your next 3 paychecks? Would you have enough in an Emergency Fund to get by? Would you rely on Credit Cards?

The Emergency Fund Route vs The Credit Card Route

Relying on Credit Cards in an Emergency:

Currently, the average credit card interest rate is 24.1% Annual Percentage Rate (APR). Credit cards are tied to prime interest rates, as interest rates have been on the rise lately, so are credit card interest rates. That means that if you’re not paying your credit card bills in full each month, the interest rate over 1 year could cost you as much as 25% of the purchase prices you originally paid.

The way compound interest works, overtime, a balance carried over will be accruing new interest charges on old interest charges, and so on. It’s a vicious cycle and nearly impossible to avoid getting deep into debt if you’re only making minimum payments!

Next time you’re about to put an item on the credit card, if you know you won’t be paying the balance off in full, add another 25% to the total and reconsider if you would pay that much for the item.

Relying on Your Own Money in an Emergency:

The key here is to stash your cash for your “Emergency Fund” in a place that is both low-risk and easily accessible. This could be a High Yield Savings Account, usually offered only at online institutions. The caveat here is that you may not be able to access your money “immediately” since a transfer over a weeknight or weekend could take a couple of days to process. Also, be on the lookout for annual fees, minimum balance requirements, etc. You can compare HYSA’s here.

Some HYSA’s offer somewhere around 3.5% right now, versus an average brick and mortar savings account, which is nationally yielding 0.23%. That means, saving the same $100/month for 1 year at these two institutions could earn you $42 in interest in a HYSA, versus $2.76 in interest in a standard savings account. That’s a big difference–just like compounding interest against us, compounding interest for us also adds up quickly!

If earning more money on your money sounds good to you, identify an amount that you would like to save, and use this tool to see how long it will take you to meet your goals!

Tip: If you’ve found a way to responsibly use credit cards (paying off the balance every month) you can use your cash-back rewards on those cards to fund an emergency fund. That’s “free” money you’ve earned, which will then earn high interest, low-risk. A win-win-win!