ICYMI: If you need in-person help from the IRS, in a rare occurrence, they are opening up on a few Saturdays, walk-in’s welcome! This is an opportunity to ask questions, resolve complex tax issues, or receive assistance on any questions you have for the IRS. To be clear, the IRS will not prepare your tax return for you; you can, however, take advantage of these free tax filing options.

Read below for more information on how to meet with an agent at a Taxpayer Assistance Center near you, and also a refresher on IRS penalties—you want to understand the financial consequences of not filing and/or not paying your taxes. Again, this is not tax advise–just some helpful information!

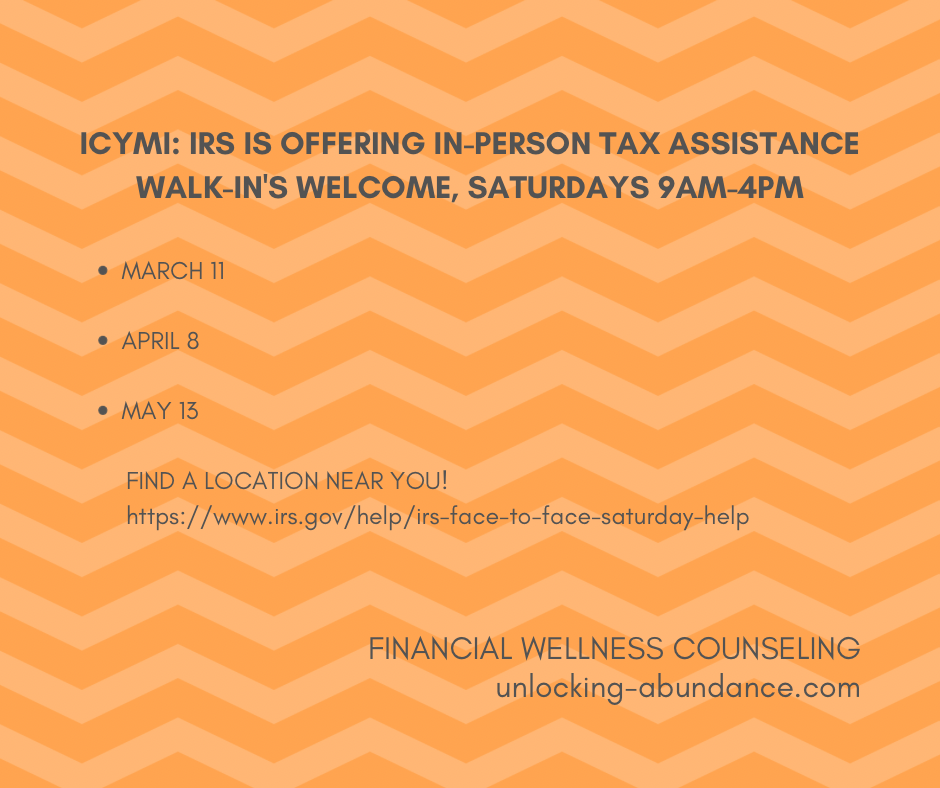

Saturday Availabilities:

On specific upcoming Saturdays between now and the tax deadline (that’s April 18, and even a little beyond) the IRS will have open slots for face-to-face tax help between 9am-4pm, no appointment needed.

–March 11

–April 8

–May 13

“These Saturday openings are part of the extra steps the IRS is taking to make a difference for taxpayers,” said Acting IRS Commissioner Doug O’Donnell. “IRS employees are working hard to help people by making improvements across our operations. These walk-in locations are critical, and funding from the Inflation Reduction Act is allowing us to add more employees across the nation to better assist taxpayers this filing season and beyond. These special Saturday hours will help people get the services they need.”

Click here to find your local office, as well as learn what to bring with you. Note: Please check this link before heading out, as changes do occur. You may see an online IRS resource, as well, saving you the trip altogether.

What’s the what on IRS penalties?! What does it cost me if I don’t file? What does it cost me if I file and don’t pay? What are my options if I file and can’t afford to pay?

First things first. There is a difference in penalties for “failing to file” versus filing and “failing to pay”, and they can be substantial.

Failure to File: If you fail to file your taxes by the Tax Deadline (this year April 18!), and do not file for an extension (Form 4858, fyi) you may to be fined 5% per month of the tax owed. Note: An extension extends the time you are allowed to file, you’re still expected to pay a reasonable estimate of what you think you might owe and send it to the IRS by the filing deadline. Thus, the filing deadline is extended, not the collection of taxes owed.

Failure to Pay: If you do file your taxes and don’t send the required taxes due by the deadline to pay, you might be fined 0.5% per month on the tax due. You read that correctly, it’s more than 5x as expensive, penalty wise, for failing to file than it is for filing and failing to pay.

In short, the IRS really wants you to file. They do have some opportunities to help make it easier to pay. For example, if you file, owe, and can’t afford to pay, there are options for both short and long-term payment plan agreements (Form 9465).

Bottom line, if you want to avoid getting deeper into debt with the IRS, file on time and/or request an extension to file, and then work out a plan to pay what you owe based on your ability. A good faith effort with the IRS could go a long way!