Recently, we touched on how to ready ourselves for taxes! Specifically, filing taxes for Individuals.

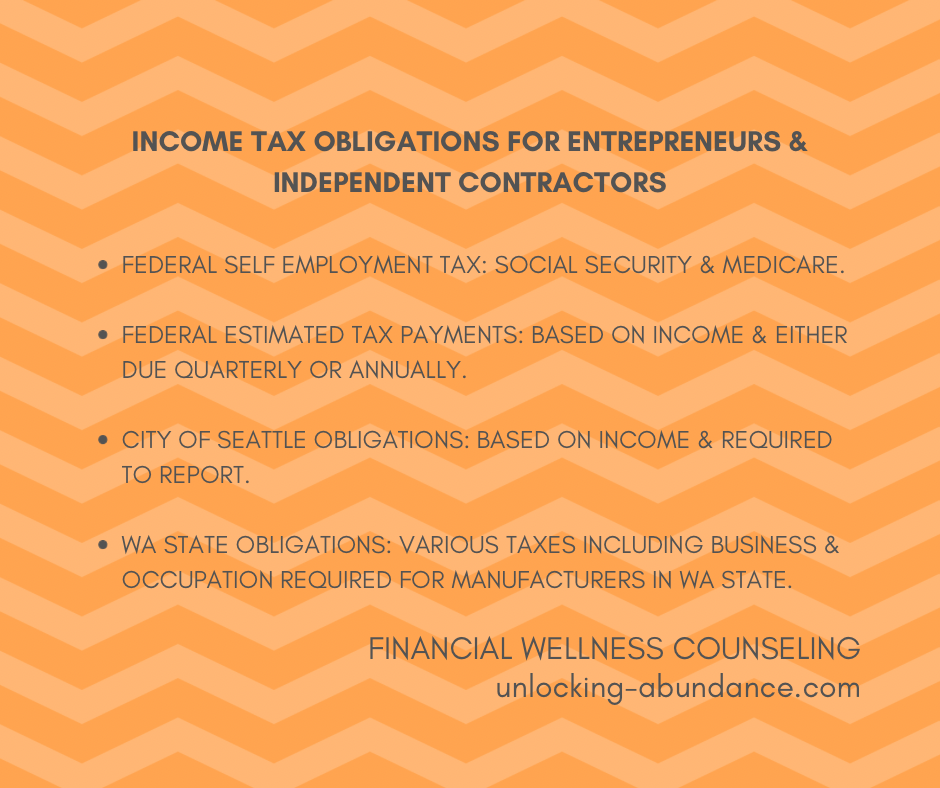

Let’s talk tax obligations for Entrepreneurs and Independent Contractors!

Whether you’re already an entrepreneur, thinking about the gazillion opportunities popping up lately for independent contractors (gig-economy, anyone?), or even dipping your toe into these territories as a side hustle, you’ll want to be aware of and understand the tax burdens; most importantly, how they’re on YOU. In other words, you don’t want to learn the hard way by receiving lots of penalties!

Read below for a few considerations regarding Federal, State and City level tax obligations you may encounter as an entrepreneur or independent contractor. Entrepreneurs have all types of businesses, big and small. They also classify as all types of tax entities with a variety of tax obligations. The purpose of this post is geared towards small business owners who consider themselves “Sole Proprietors” and Independent Contractors. And, as always, this is educational-only talk, and NOT TAX ADVICE. It’s best to consult with a tax professional who is an expert in your unique tax situation.

Entrepreneur vs. Independent Contractor: What’s the difference?

Entrepreneurs are self-employed folks who create businesses and are responsible for all risk, costs, and profits. An Independent Contractor, or free-lancer, is also a self-employed individual, but they tend to specialize in a specific skill. They are hired and may work for many different companies for a contracted amount of income and time. An entrepreneur may hire an independent contractor. Both are required to take care of their own tax obligations. Tip: If you’re self-employed, a good rule of thumb is to set aside about 30-35% of income earmarked for tax bills. This should cover the various types of taxes you may be exposed to including Federal Income and Self Employment Tax, and any State and City required tax (see more on this below).

Typically, by January 31, businesses are required to send out 1099’s to any eligible individuals or small businesses they contracted with for services in the prior year, to whom they paid more than $600. Note: these are not for employees on payroll, but contracted services and free-lance vendors. Additional Note: Once these forms go out, the IRS is essentially “cc’d” with their own copy. Therefore, if you receive a 1099, just know that the IRS received one on your behalf as well. The 1099 will reflect how much the independent contractor or individual was paid and will usually show no tax withheld from those earnings. Again, if you receive a 1099, taking care of those taxes is on you.

If you received a 1099:

Check to make sure all information is accurate, especially the wages amount. If anything looks incorrect, contact the company listed on the 1099 (phone numbers are required) and ask that you get a corrected copy before you file your taxes.

Now, let’s break it down–as a self-employed person, I’m responsible for paying what, exactly???

The following is a list of taxes that small business owners or independent contractors may be required to pay:

Federal Income Tax:

The tax paid on your taxable income, depending on filing status, and based on IRS tax brackets.

Federal Self-Employment Tax:

For larger business entrepreneurs who have payroll, this covers Social Security and Medicare and can be split among the business and any employees. However, for the self employed with no employees, and also independent contractors, you are required to pay both the employer/employee portion and the tax rate currently runs about 15% after any qualified business deductions.

Federal Estimated Tax Payments:

Similar to working for an employer and having taxes taken from your paycheck, the IRS wants to receive the money from self-employed folks around the time it was made. Tip: The rule of thumb here is if you expect to have a tax bill of $1k+ this year (or you did last year) you might be required to pay Estimated Tax Payments to the Federal Government throughout the year. If you miss this step, these payments will be due when you file your taxes, possibly along with a penalty. Making these payments throughout the year will theoretically leave you with a much smaller bill at filing time. More info on Estimated Tax Payments for the self-employed and independent contractors.

These payments can be paid online and follow this schedule of due dates this year:

January 16, 2023: Q4 Previous Year Estimated Tax Due

April 18, 2023: Q1 Current Year Estimated Tax Due

June 15, 2023: Q2 Current Year Estimated Tax Due

September 15, 2023: Q3 Current Year Estimated Tax Due

Tip: If you know you’re going to make the $1k+ tax bill for the current year and be required to send Estimated Tax Payments, base this year’s expectations at 110% of whatever you made at the same time last year.

State and City Tax Obligations:

State: These vary from state to state. Here in WA State where we have no income tax, entrepreneurs may be required to report business income to The Washington State Department of Revenue based on your type of business. You could be responsible for Business & Occupation, Retail Sales, Property and Use Tax. Payments are due quarterly or annually, depending on income amounts.

City: Again, these vary by city. Here in Seattle WA, entrepreneurs are required to file even if you have no business activity. If you have an annual income of over $100k, you owe Business & Occupation tax on the gross revenues. This is filed separately from State taxes.

Feeling overwhelmed with tax obligations? First, deep breath! This is a lot of content to take in and being self-employed requires a big investment of learning up front. It can be stressful to think you’re “not doing it right”. Let that go. When you know better, you do better.

Some Helpful Resources:

Small Business Guidance for Washingtonians, searchable by County & City.

Your local chapter of the Small Business Administration.

WA State Dept of Rev which addresses both State & City obligations.

The most important message here is, don’t let perfectionism or fear of “getting it wrong” keep you from filing! Ask for help! Seek a professional tax advisor. When in doubt, file the thing! It’s much worse to pay fines for lack of understanding than over-filing and getting a refund. You’ll get a much more compassionate response from Federal, State and City powers-that-be when it appears you are making an effort to step up to your tax obligations. You got this!