If you have taxes on the brain right now, you’re not alone! The IRS officially opened their doors to process Tax Year 2022 returns on January 23. This year, we have until April 18th to get our taxes done.

Although I am a certified Volunteer Income Tax Assistance (VITA) tax preparer, I am not a Tax Advisor. The following is a guide–not tax advice!

Read below for a checklist to get you started, some changes you can expect this filing season, and a few resources you may find helpful along the way!

A Checklist to Get Prepared:

–Your personal data including SS#’s for anyone on the return (including dependents!).

–Identify where you will file your taxes. The IRS free file sites are for AGI<$73K.

As I’m personally fond of, in person and virtual VITA Tax Prep sites.

–Your decision to take the Standard Deduction or Itemize. The Standard Deduction requires a lot less paperwork, but, if you think you shelled out (for most Itemizers) more than $12,950/Single, $19,400/Head of Household or $25,900/Married in things like Property Taxes, Out of Pocket Medical, Charitable Contributions, etc. it could be worth it to track all of the evidence, calculate, and write off all of your expenses by Itemizing.

–Your Wage amounts and forms from all sources of income. Tip: Even if you don’t receive a 1099 for work you did for money (the due date to mail those out was Jan 31, btw) you’re still required to claim the amount you were paid. If the amount is below $400 you will not be taxed. If it is above $400, expect to pay self-employment tax of up to 15% after you take out your eligible expenses. Additional Tip for Entrepreneurs: Printing last year’s bank statements for whichever credit/debit card you used to pay for business expenses is an easy way to highlight and categorize. A user-friendly guide to small business expenses and their tax implications can be found here.

–Your forms showing Interest earned on any Savings/Investment accounts.

–Your Health insurance form showing who provided yours and your cost, if any, in 2022.

–Your Last year’s Tax Form 1040. Especially helpful if you pay someone to do your taxes for you. In that case, your photo ID will be required as well. Another Tip for Entrepreneurs: Unless you are extremely confident in math and the current tax laws, it’s a good idea to pay someone credible to do your taxes for you. Even the smallest errors can turn into expensive headaches!

–Your bank account numbers for direct deposit refunds or payments. Tip: e-file and direct deposit get you your refund much much faster!

–Your daycare provider’s tax ID/Business info if claiming any dependent care costs.

–Your forms showing tax deductible expenses such as Educational Expenses from an accredited institution, or contributions made with after-tax dollars such as to a Health Savings Account (HSA).

–Any other miscellaneous tax forms including withdrawals made from accounts such as a retirement savings, HSA, etc.

–Make any final contributions you want to count for 2022 to Retirement & Health Savings Accounts. Contributions to those are the same as the general tax filing deadline of April 18, but you’ll want to make them before you do your taxes. This is particularly important for the Saver’s Credit (see below).

Take Personal Inventory of 2022 aka Big Life Changes:

Did you get married, have or adopt a child, get divorced, start a new job, move, buy a new vehicle, etc.? All of these, and more, may impact your tax return this year. Changes to, or creating a new W-4, and even new employee benefits can have an impact.

Where you a victim of identity theft? The IRS will send you an IP PIN to use when filing in order to prove you are you.

If you bought a new, qualified, plug-in electric vehicle in 2022 or before, you may be eligible for a clean vehicle tax credit.

Changes to Expect Filing This Year:

The word on the street is that many filers might have a smaller refund this year compared to the last couple. This is because many Covid policies are expiring. For example, there was no stimulus for 2022, so that’s off the table.

We can no longer deduct $300/person for Charitable Contributions with the Standard Deduction; we must Itemize.

The Child Tax Credit (CTC) has dropped from $3K to $2K per child, and the child must be age 17 or under rather than 18 to qualify.

The Earned Income Tax Credit (EITC) which is based on income and number of dependents is smaller this year. Tip: for those parents who share custody, decide who is claiming the child. Every EITC return is audited; you don’t want to get this one wrong.

Speaking of the EITC, a brand new state credit launched this year, the WA State Working Families Tax Credit! This matches the EITC in eligibility and provides a refund from the state, in addition to Federal.

The Saver’s Credit is for those who contribute to an IRA or retirement plan and are under the Adjusted Gross Income (AGI) of $34K/Single, $51K/Head of Household or $68K/Married. You may be able to receive a credit of up to $1K-$2K depending on your filing status.

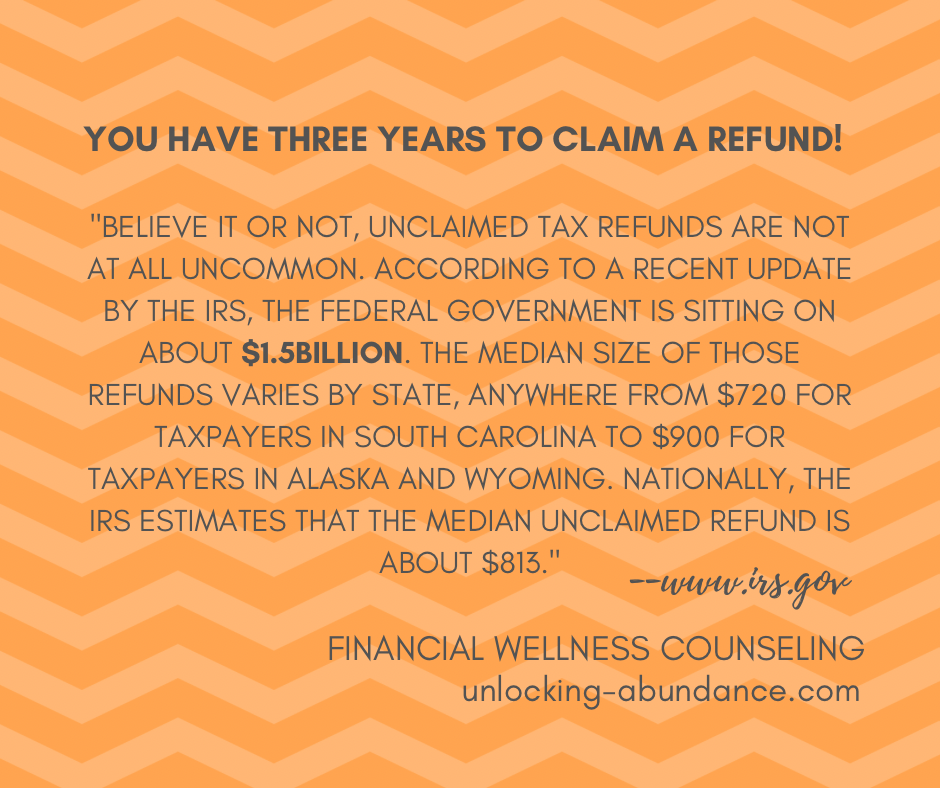

Haven’t been filing? You can claim a refund or make an Amendment to a previous tax return up to 3 Tax Years retroactively. This is particularly important if you’re eligible for Child Tax Credit or Earned Income Tax Credit. You could be leaving money on the table!

As always, around taxes, be vigilant! Remember, the IRS will only contact you by mail. And lastly, this is a reminder that no matter who prepares your taxes, even paid services, the content/mistakes are ultimately on you. Now get going!