In case you missed it, Washingtonians may be eligible for a new, state-level, tax credit this year! The Working Families Tax Credit is a new tax refund for working (in Tax Year 2022) individuals/families, through the WA State Dept of Revenue. It is income and family-sized based. Applications open February 1, 2023. Read below for the ins and outs of this new state credit, including how you can find out if you are eligible!

The What:

The Working Families Tax Credit is a new state-sponsored tax refund for working lower-income individuals and families.

The credit is available to working individuals and families who qualify as a refund of a portion of their WA State Sales Taxes paid.

It is modeled after the Earned Income Tax Credit (EITC) which is available on the federal tax return.

“The purpose of the Working Families Tax Credit is to stimulate the local economy, promote racial equity, and support the financial stability and well-being of low-to-moderate income Washington residents and their families.” (WA State Dept of Revenue).

Individuals and families may receive a refund of $300-$1200 back based on their qualifications.

Applications are accepted thru December 31st, 2023.

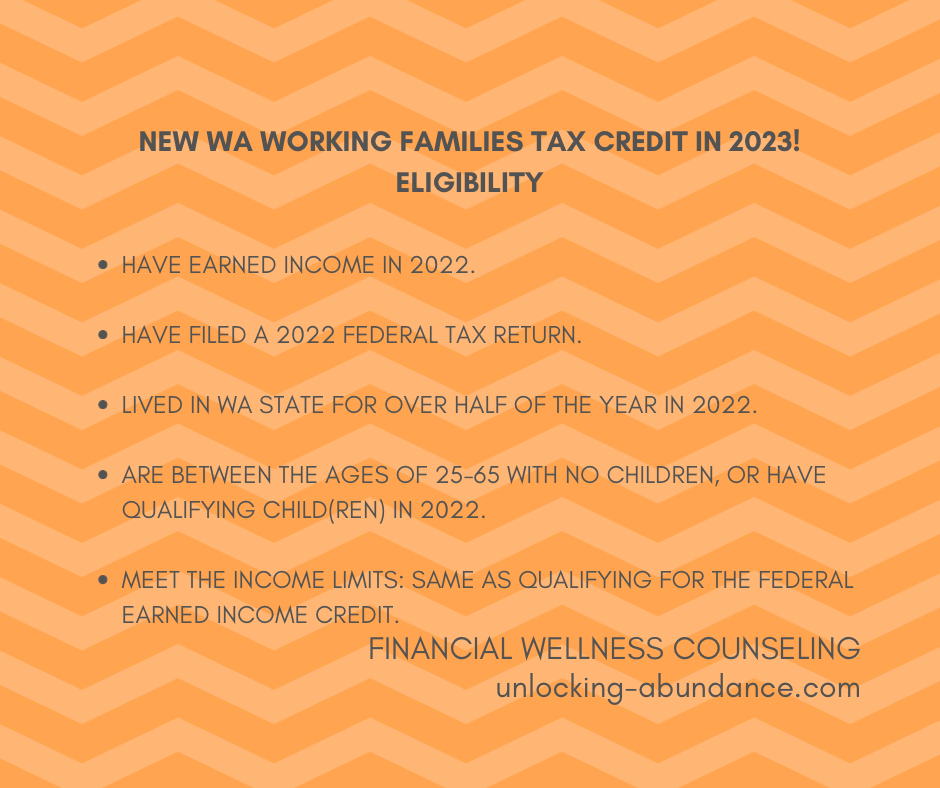

The Who (eligibility):

Applicants must meet the following criteria:

Have earned income for 2022 but are not required to be employed at the time of receiving the credit.

Have lived in WA State for at least half the year in 2022.

Must be between the ages of 25-65 OR have a qualifying child for the credit.

Must file a federal tax return in 2023 for Tax Year 2022; with some tax prep software claiming this credit can be done at the same time (see below).

Family Size/Income Limits/Maximum Refund Amount

0 Children, 2022 Annual Income cannot exceed $16,480/Single or $22,610/Married, $300 Maximum Refund

1 Child, 2022 Annual Income cannot exceed $43,492/Single or $49,622/Married, $600 Maximum Refund

2 Children, 2022 Annual Income cannot exceed $49,399/Single or $55,529/Married, $900 Maximum Refund

3+ Children, 2022 Annual Income cannot exceed $53,057/Single or $59,187/Married, $1200 Maximum Refund

The How (to claim the credit):

See if you qualify! If you do qualify, and have completed your 2022 Taxes, apply online!

Haven’t done your taxes yet and intend to do your own at home? This list of tax prep software is set-up to include access to the credit.

More questions about this credit? Click here!