ICYMI just before closing out 2022, congress passed The Securing a Strong Retirement Act (otherwise known as the “Secure Act 2.0”) as an expansive sequel to The Secure Act of 2019 which was designed make saving for retirement easier.

Before you start thinking, “This blog post is not for me; I don’t have any money to save for retirement right now!” give it a second to see if you might qualify in either the Student Loan Payer Eligibility, the Lower Income Matches, Part-time or Gig-economy Worker Opportunities, or even the Emergency Fund Option.

In other words, Congress got unusually creative this time around!!

This new bill effects young people just getting started, those in the middle who feel contributing to retirement is still out of their reach, and those that have been saving for decades and see retirement in their near future.

As usual with government legislation, these changes will take time to kick in.

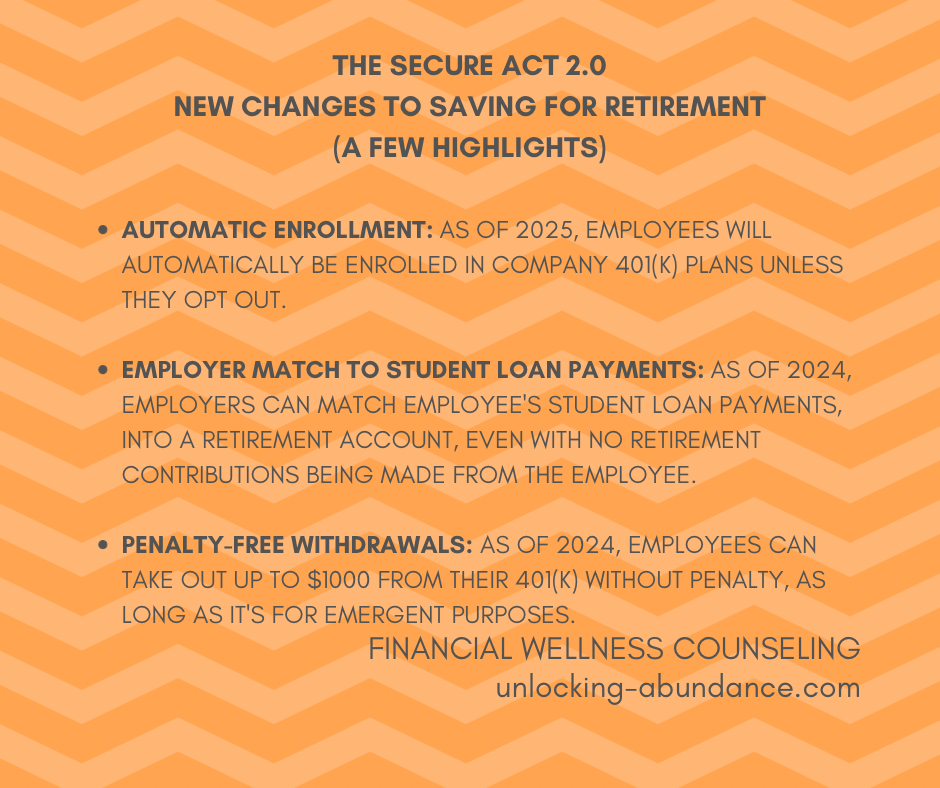

Read below for a few highlights from what we can all expect from this 1.7T$ package now and over the next few years.

As of 2023,

*Small businesses with 50 or fewer employees can qualify for a 100% credit for the cost of establishing a workplace retirement plan.

*Required Minimum Distributions (the age for mandatory 401(k) or Traditional IRA withdrawals in retirement) will be raised from 72 to 73.

As of 2024,

*Employees will be eligible to be enrolled in “Emergency Savings Accounts” with after-tax dollars that are linked to their Retirement Accounts, up to $2,500. Withdrawals on the emergency fund accounts are tax-free.

*Workers can also withdraw up to $1k a year from their 401(k)’s without penalty as long as the withdrawal is for an emergency.

*Employers would be allowed to make a contribution to an employee’s retirement plan that matches the employee’s student loan payment, even if an employee isn’t yet able to contribute to their 401(k) plan.

As of 2025

*Enrollment in the 401(k) at companies with more than 10 employees will be automatic, unless you opt out.

*Part-time & Gig Economy workers who work a minimum of 10hrs/week can contribute to an employer-sponsored retirement plan after 2yrs of employment.

*Employees aged 60-63 catch up contributions for retirement increase to $10k/year.

As of 2027,

*Employees with income under $35,500/Single or $71k/Married will be eligible for a “Saver’s Match” from the Federal Government on their retirement contributions of $1k if they save up to $2k/year on their own, in a retirement account. This will replace the tax credit currently in place and the funds will go directly into the retirement account, rather than waiting to see it on the tax return.

Miscellaneous Changes:

There will be a “lost & found” database where workers can easily find retirement accounts left behind and often forgotten about at previous jobs.

These were just a few highlights! Questions about how you might be affected by this bill? See a fee-only fiduciary advisor who specializes in tax planning with any questions.