Since we’re still in Open Enrollment, I just wanted to post a quick personal story of how my Health Savings Account (HSA) really saved me from incurring major medical debt this year!

We’ve gone over how the use of Sinking Funds can help us to save up for things all year.

This is the strategy I personally use in order to pay for medical costs out of pocket.

Specifically, I look at the year ahead and I anticipate how much I might be on the hook, as far as RX’s, Co-Pays, and routine medical care.

Let’s say my Annual Deductible will be $3k next year, and I think I can save up a third of that, or $1k over the whole year.

I’d take the $1k amount and divide it by 12 months.

I would then set up an auto transfer (convenience is a huge part of building sustainable habits!) of about $85/month to my High Yield Savings Account in order to meet that goal.

The money is growing all year, I’m not having to do anything, and the money is actually making me more money since High Yield’s are actually “High Yield” right now! (Take advantage of today’s interest rates!)

Then, every time I get a reasonable medical bill or pay for a RX or Co-Pay, I just transfer back to myself what I spent.

This year, particularly, I had some high (for me) medical bills!

I had to have surgery for the first time as an adult; hospital stay and the works.

Luckily, for me, I have access to a Health Savings Account (HSA) that I contribute to regularly (a small amount I can afford—again, budgeted and auto-transferred, I don’t even notice).

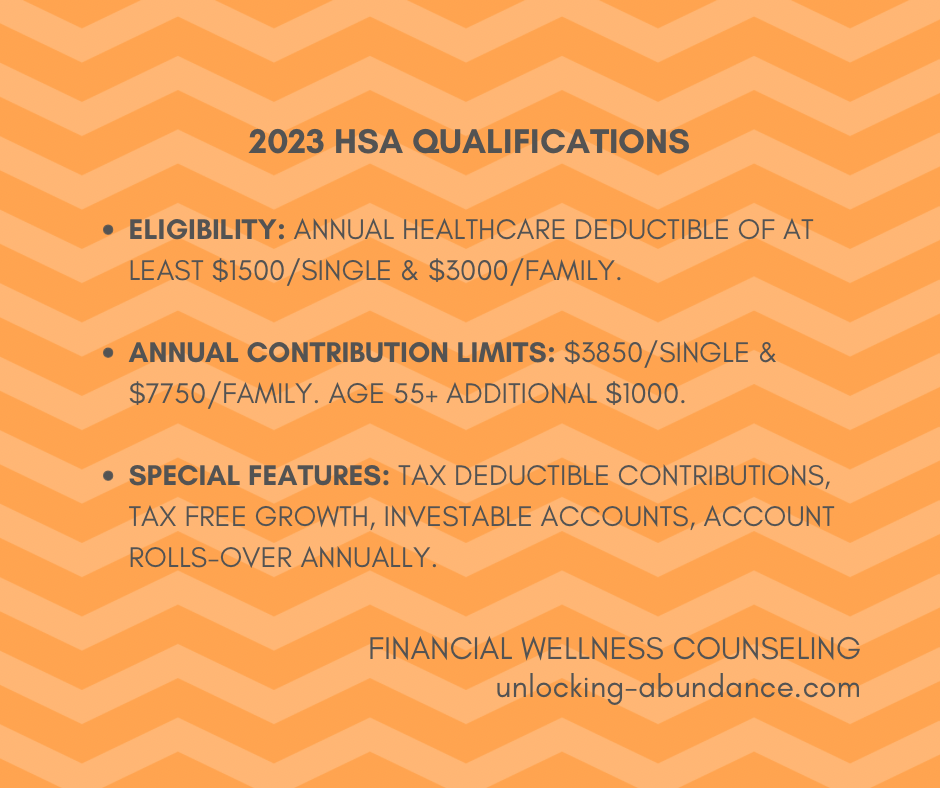

I compared HSA’s and FSA’s here: https://wordpress.com/post/unlocking-abundance.com/207. Each have their own features and everyone one has to choose which one is right for them and their unique situation.

For me, when I first opened the HSA, I padded it with the amount of my annual deductible at that time and just let that money sit.

My extra contributions into the account continue to grow that initial sum.

This year, each time I received one of those large medical bills that was beyond what I had budgeted in Sinking Funds for “routine medical expenses”, I took a draw from the HSA account (fancy way of saying I transferred money to myself, easy to do online).

I cannot describe the relief of getting a “large” medical bill and being able to just transfer the money over and have it be taken care of!

Being new to good money management, the old me would likely have not had nearly enough in savings and would have had to get on a long-term hospital payment plan that would have impacted me and my financial goals for years.

Also..and this is the magical-ninja part of the whole process..the money I spend out of the HSA account for medical expenses is NEVER TAXED.

Think of it as if you did your job at your hourly rate for cash only, stored up that cash, and then threw it at a medical bill.

NO taxes are taken out. Thus, technically, you’re getting a “discount” on medical costs when you use money from the account.

Caveat: the above story is something that worked for me, in my personal situation.

All of our goals, incomes, needs, etc. are different!

The most important thing is that we’re all educated about our choices and opportunities.

Learn more about using HSA’s here https://wordpress.com/post/unlocking-abundance.com/208.